From a strict accounting standpoint, the costs of keeping your company up to date with technology are considered expenses that will be reflected in your profit and loss (P&L) statements. Savvy bankers, however, treat these costs as an investment. Technology investments can help to enhance efficiency, freeing staff time up to focus on the strategic priorities that can lead to a healthier bottom line. They can also help your business gain a competitive edge. That’s how firms outside of the financial services industry tend to view their technology and you should too. Your investment in technology can help drive real economic returns as long as you’re focused on optimizing them.

Technology should drive financial outcomes

When you think about it, there is never a legitimate reason to invest in technology without a target outcome in mind. That return might involve an increase in productivity, a reduction in fraud—or the ability to expand your market reach. Evaluating new technology, therefore, should be done based on the impacts it will have.

These investments, then, can be framed to explicitly convey their intended benefit. For instance:

- A $4 billion bank is considering the opening of a digital branch. It sets the goal of raising $500 million in core deposits over a one year period through the new digital channel.

- A $2 billion credit union wants to give its members the ability to open IRA accounts online. It could set an increase in cross-sell conversion rates as the target.

This isn’t a new or controversial approach to take. However, it’s not uncommon for bankers to take a“tick the box” approach with their technology choices. That is a very flawed approach.

Beyond cost: considering ROI

When making or proposing implementing new technology, identifying the costs of that investment is relatively straightforward. Forecasting the return on investment (ROI), of course, can be more challenging. Despite that uncertainty, though, financial leaders can still put a stake in the ground to estimate the impact of new technology both on cost savings and revenue generation.

These estimates aren’t absolutes and leaders should make it clear that their numbers are, indeed, estimates. But by sharing the assumptions that went into the calculations and backing them up through internal and external research and best practices, financial leaders can build a business case to support their recommendations. In addition, offering a range of potential outcomes—from good, to better, to best—leaders can illustrate that even a “good” return will drive dollars to the bottom line.

ROI analysis as part of the vendor selection process

Technology vendors have an opportunity—in truth, a responsibility—to work with potential clients to identify the potential return on the investment they’re about to make. The best vendors will be able to provide you with the data and references to help you build a realistic business case for your technology investment. These target outcomes should then inform the implementation process to ensure every decision ultimately builds to the defined measure of success.

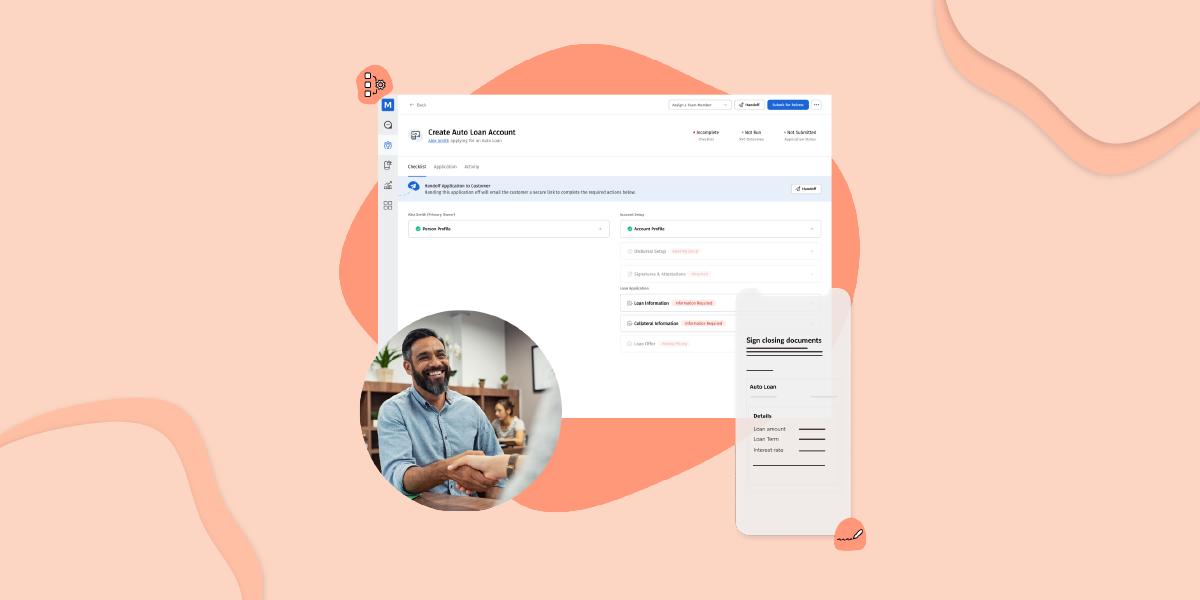

Learn how you can grow deposits more efficiently with MANTL’s online account opening software.