Fuel growth and deepen customer relationships

Supercharge growth while modernizing your consumer and small business lending programs with a unified loan and deposit origination platform that provides advanced tooling and automation across KYC, underwriting, and booking.

For Banks

For Credit Unions

MANTL simplifies and automates the entire loan origination process, providing an exceptional customer experience and creating a scalable loan engine built for trust and growth.

Growth & cross-sell: Real-time insights boost conversions and customer value.

Scalable automation: Automate decisions and integrate with core systems to expand services.

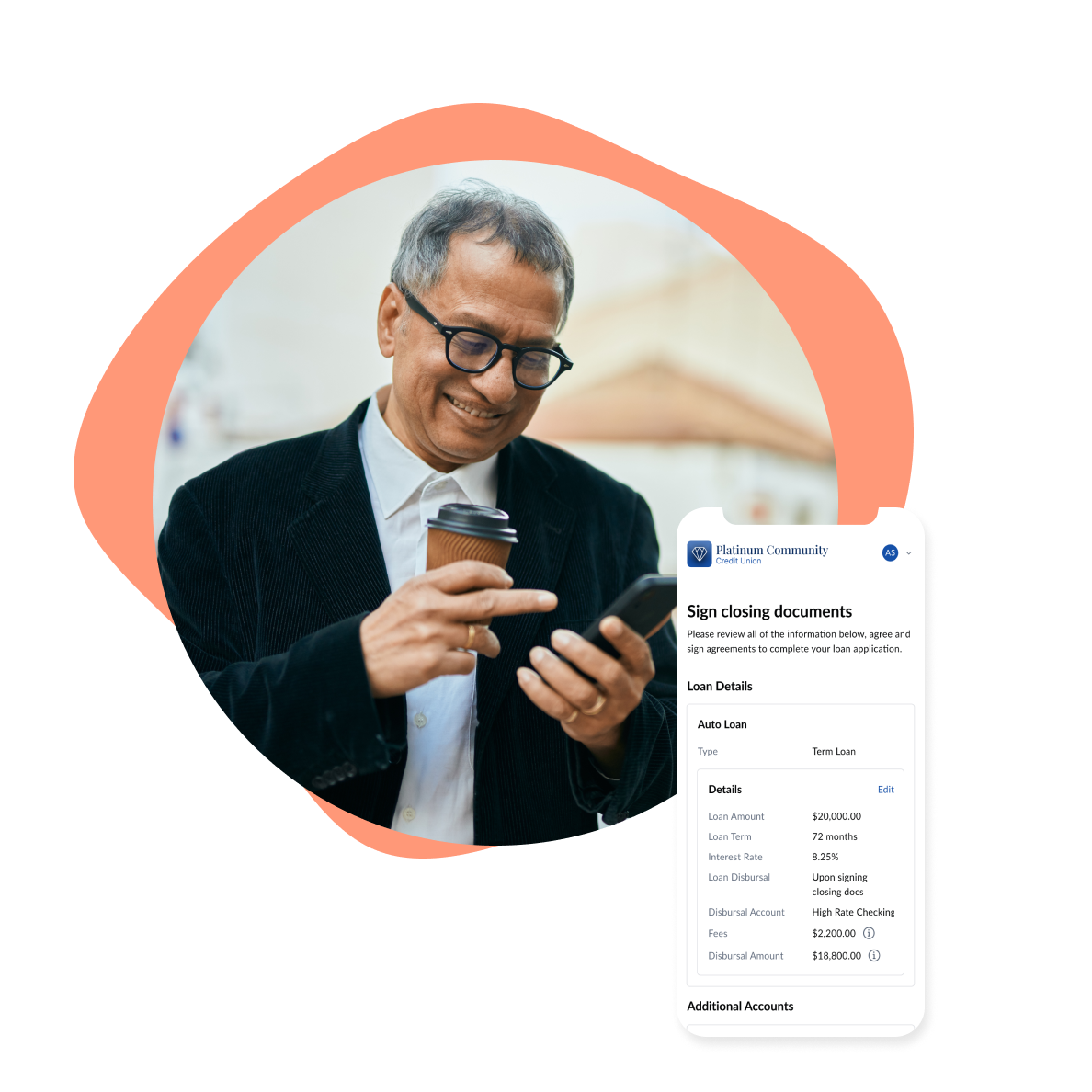

Digital experience: Modern, mobile-first design enhances customer satisfaction.

MANTL simplifies and automates the entire loan origination process, providing an exceptional member experience and creating a scalable loan engine built for trust and growth.

Member engagement: The unified platform delivers a superior experience across channels and products

Loyalty & retention: Targeted cross-sell options drive member loyalty

Efficient operations: Fully digital application and document management to streamline member and employee workflows

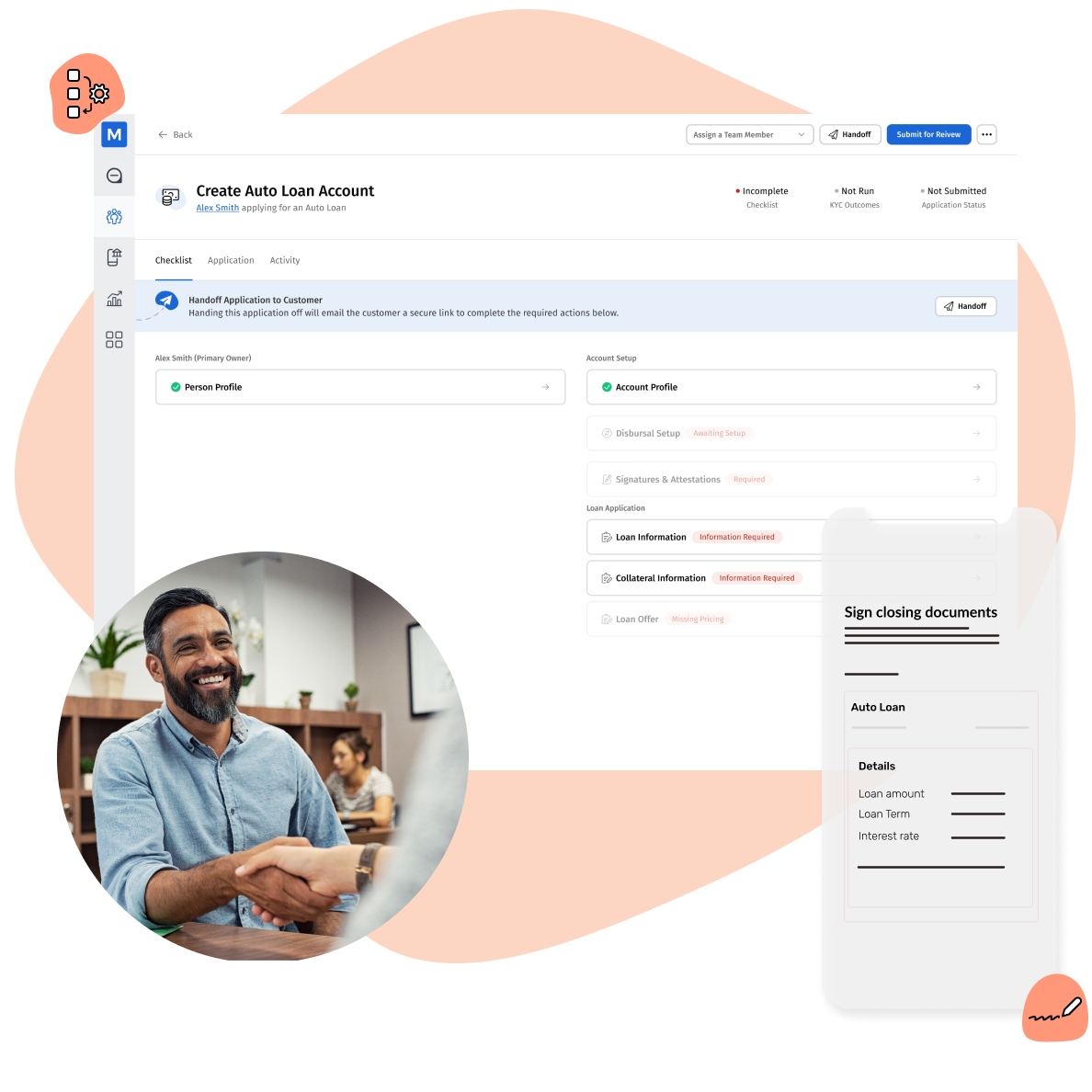

A better way to serve your borrowers

Turn every loan interaction into a chance to deepen relationships.

Improve member satisfaction and value with a unified and intuitive experience across loans and deposits.

Deliver instant value with real-time disbursement of funds on approved loans under a specified value.

Serve more members with personalized loans and offers, based on detailed and real-time data.

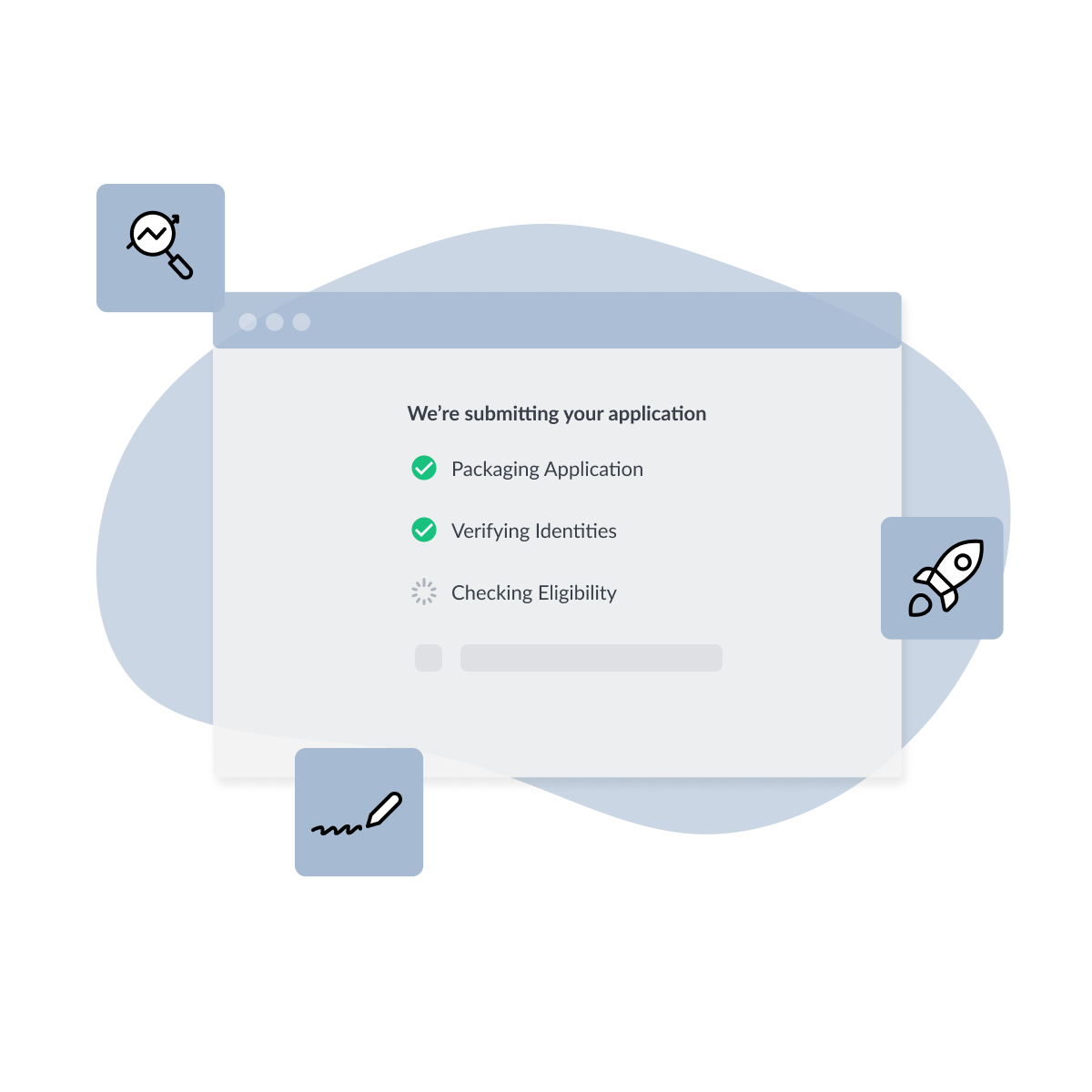

Elevate efficiency, maximize value

Engage borrowers with real-time cross-sell opportunities with tailored offers based on real-time insights, turning each interaction into an opportunity for loyalty and lifetime value.

Reduce fraud with advanced fraud protection built into every step of the pre-approval workflow, securing your institution’s assets and safeguarding borrowers.

Configurable and automated KYC and underwriting capabilities streamline your workflow, providing faster, more accurate assessments without sacrificing thoroughness.

Streamline document management, simplify banker tooling, and automate manual tasks to meet your institution’s unique needs—all designed to reduce friction and enhance productivity.

Boost engagement through your loan platform with automated outreach for abandoned applications, adverse action updates, and onboarding. Keep borrowers informed and engaged, enhancing loyalty and lifetime value through consistent, personalized communication.

Proven partner for financial institutions

With deep industry expertise and a robust network of integrations, this lending solution is designed to help banks and credit unions thrive— Pre-built analytics for data-driven decisions, expert guidance on best practices and extensive integration capabilities to fit your existing infrastructure.

The MANTL team is working right alongside us to meet our objectives, both short-term and long-term, and together we have built a next-level digital front door. MANTL is a true partner. They understand our business model. And they offer the kind of expertise and insight that will help us innovate and grow in the years to come.

Sumeet Grover, Chief Digital and Marketing Officer

The right technology partner can make all the difference in a successful rollout. We have a true partner in MANTL - it’s not just a technology vendor-buyer relationship. We have fair expectations of one another as partners, and we were able to get through implementation smoothly, while on time and on budget.

Rudy Beeching, EVP, Managing Director of Retail and Business Banking

When we build our tech stack, we are looking for agile partners with like-minded visions for its core services that will continue to move forward with us as we evolve. We don’t even like to use the word ‘fintech’, because we choose partners that operate like an extension of our team. MANTL helps us better serve our members and our community.

Jessica McNier, Senior Vice President of Technology & Innovation

MANTL is changing the behavior of our employees and customers and has encouraged GSB to adopt a more digital-first mindset. The impact is felt across our organization.

Alex Sulpasso, EVP, Client Experience Officer

When technology providers authentically involve their clients to collaborate on new market solutions, they become an extension to the mission and strategies individually, and for the betterment of the collective. With MANTL, reimagining the processes for business deposit origination will provide Black Hills FCU business members the easy and intuitive experience they have come to expect with their personal accounts.

Steve Pierce, Vice President, Innovation

Early Access