Grow your business relationships

Transform customer and employee experience with omnichannel account opening to unlock deposit growth and increase operational efficiency

TRANSFORMING FORWARD-THINKING INSTITUTIONS

Built for businesses. Geared for growth.

MANTL delivers a best-in-class banking experience for businesses of all sizes — from small businesses to complex commercial enterprises.

< 10 min

80%

~7k

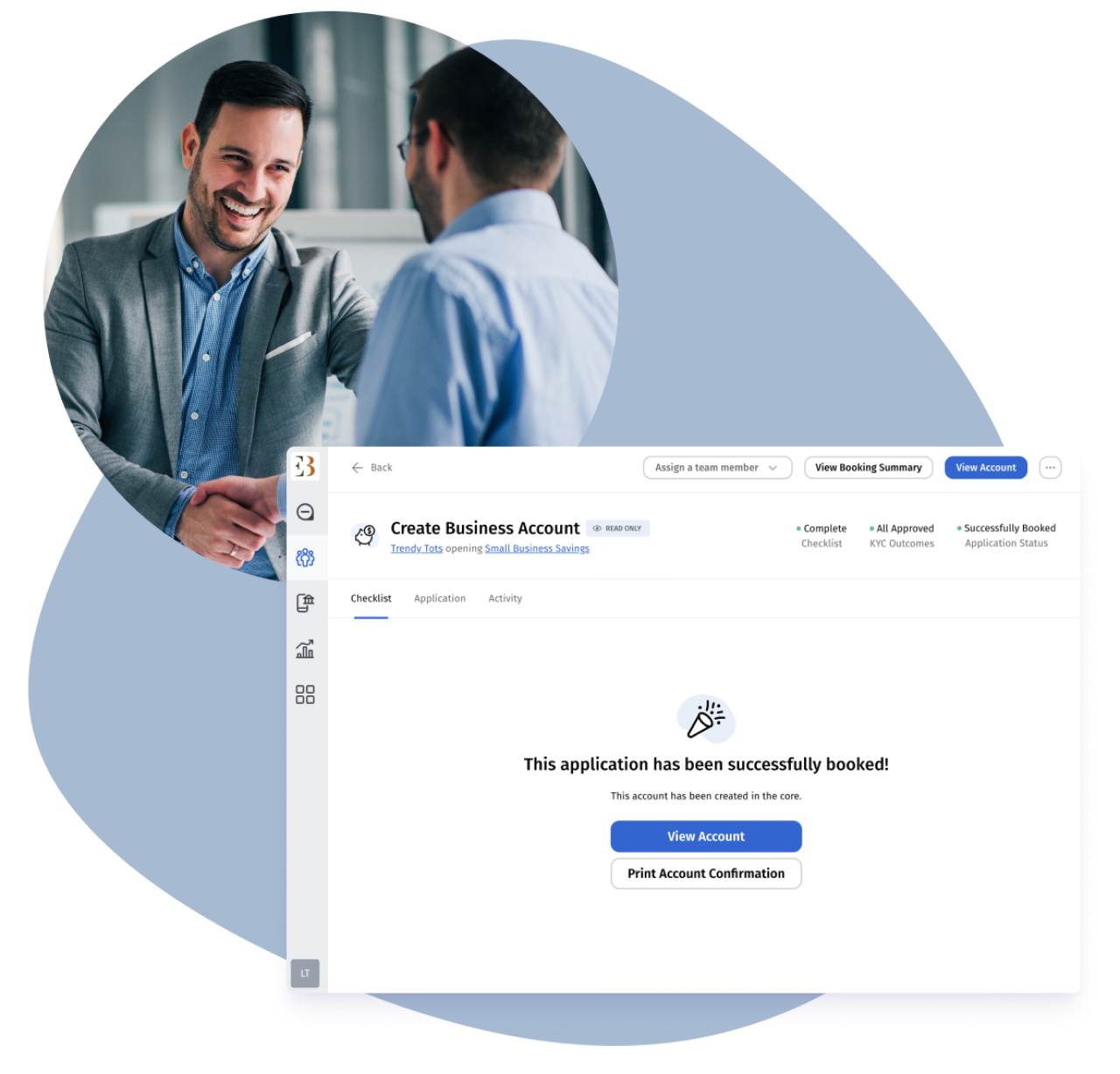

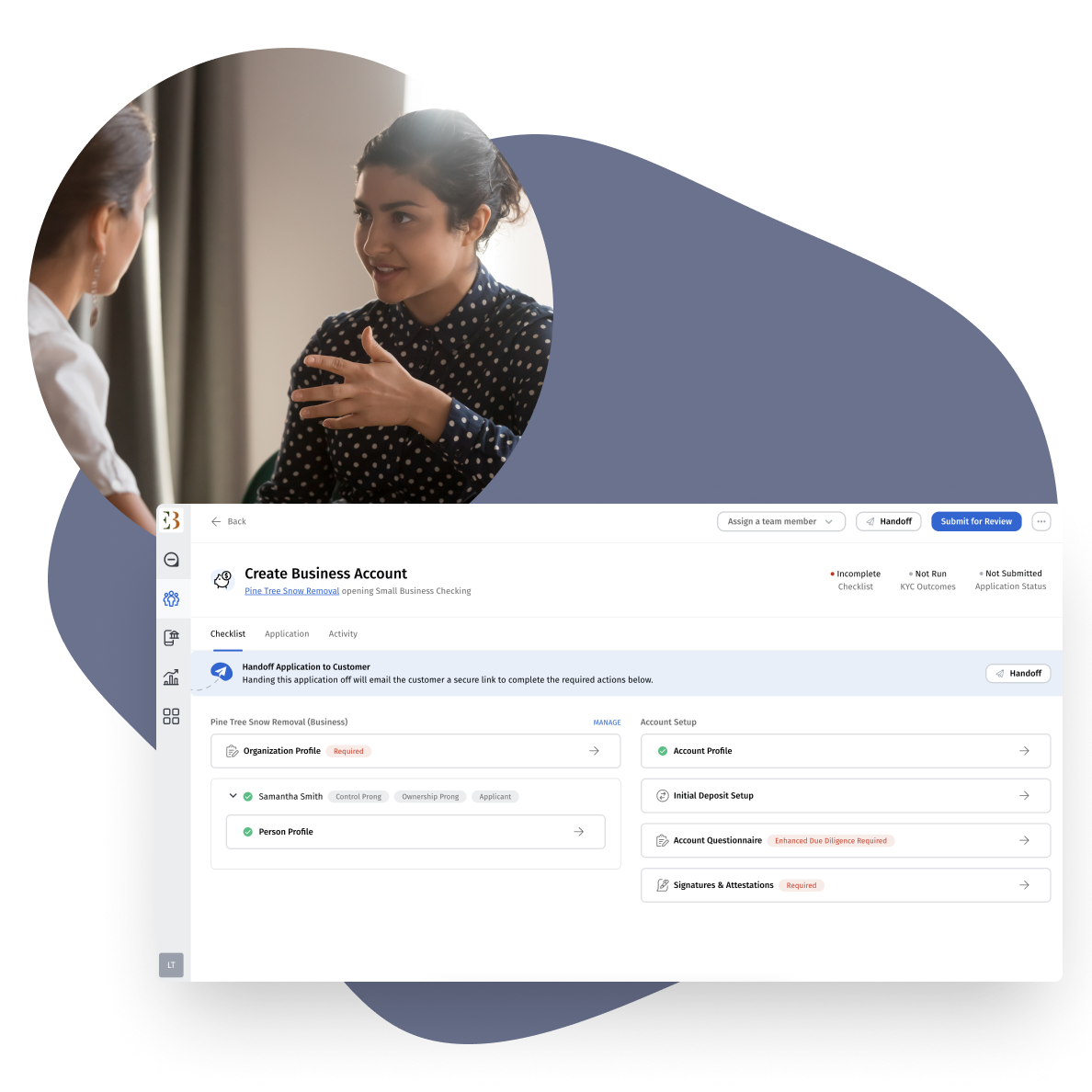

Modernize branch and banker technology

Improve operational efficiency and empower employees with modern and intuitive account opening technology

Application checklist to clearly guide relationship managers and simplify workflows

Secure digital document collection and signing to streamline processes and reduce friction

Streamlined fulfillment of product services to encourage product adoption and improve customer experience

Empower team members and improve efficiency

MANTL has made the biggest impact on our BSA team - they no longer spend a significant amount of time manually reviewing accounts or creating workarounds. Everything can be done intuitively on the MANTL platform. This level of automation is a game changer.

Danielle Kane, Director, Small Business Banking

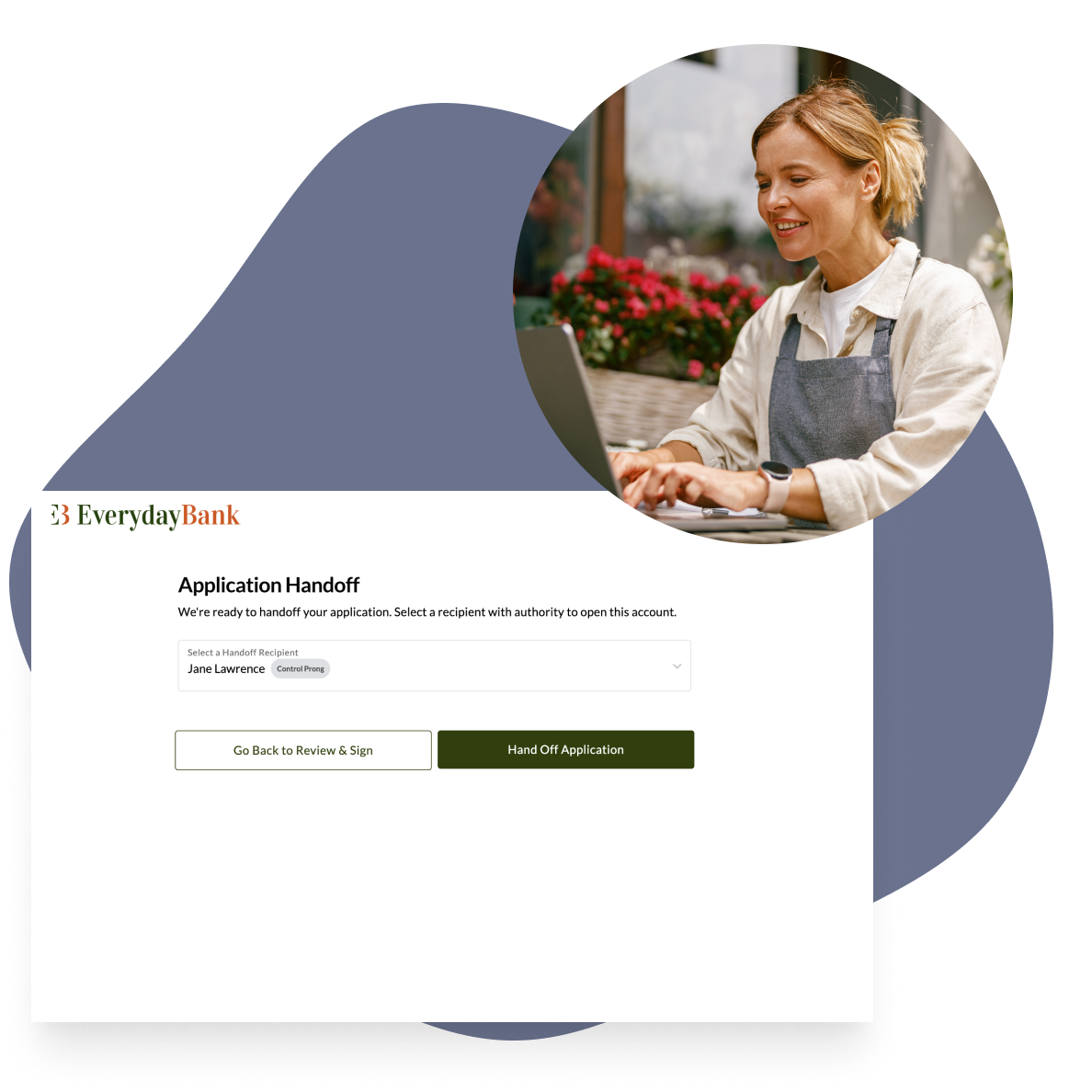

Scalable white-glove digital experience

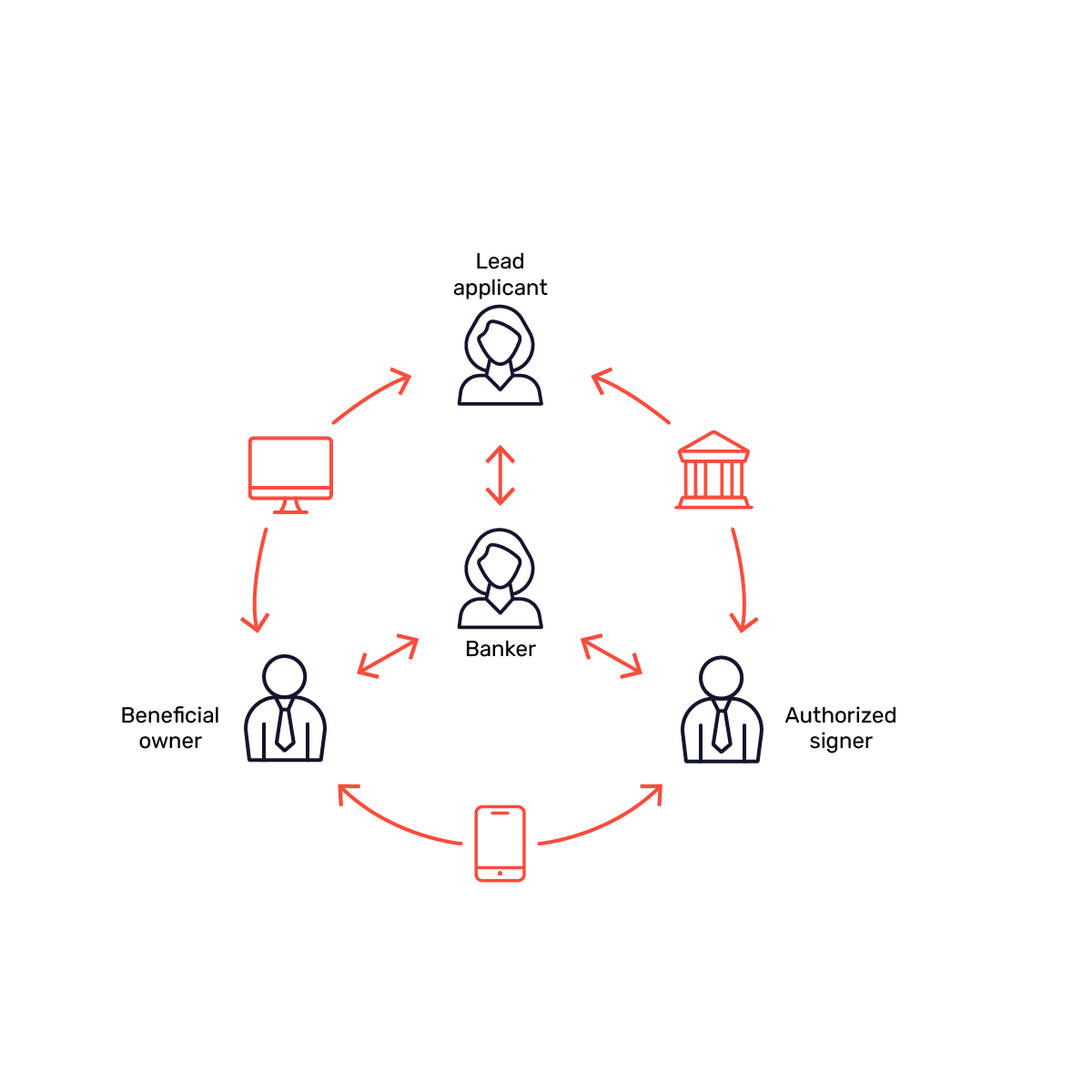

Support fully online, fully banker-led, or any combination to cost-effectively serve businesses of all complexities

Simple and accessible digital interface to streamline information collection

Secure and seamless application syncing to enable businesses to start applications online and complete in a branch or via call center

Streamlined digital signature process across business owners

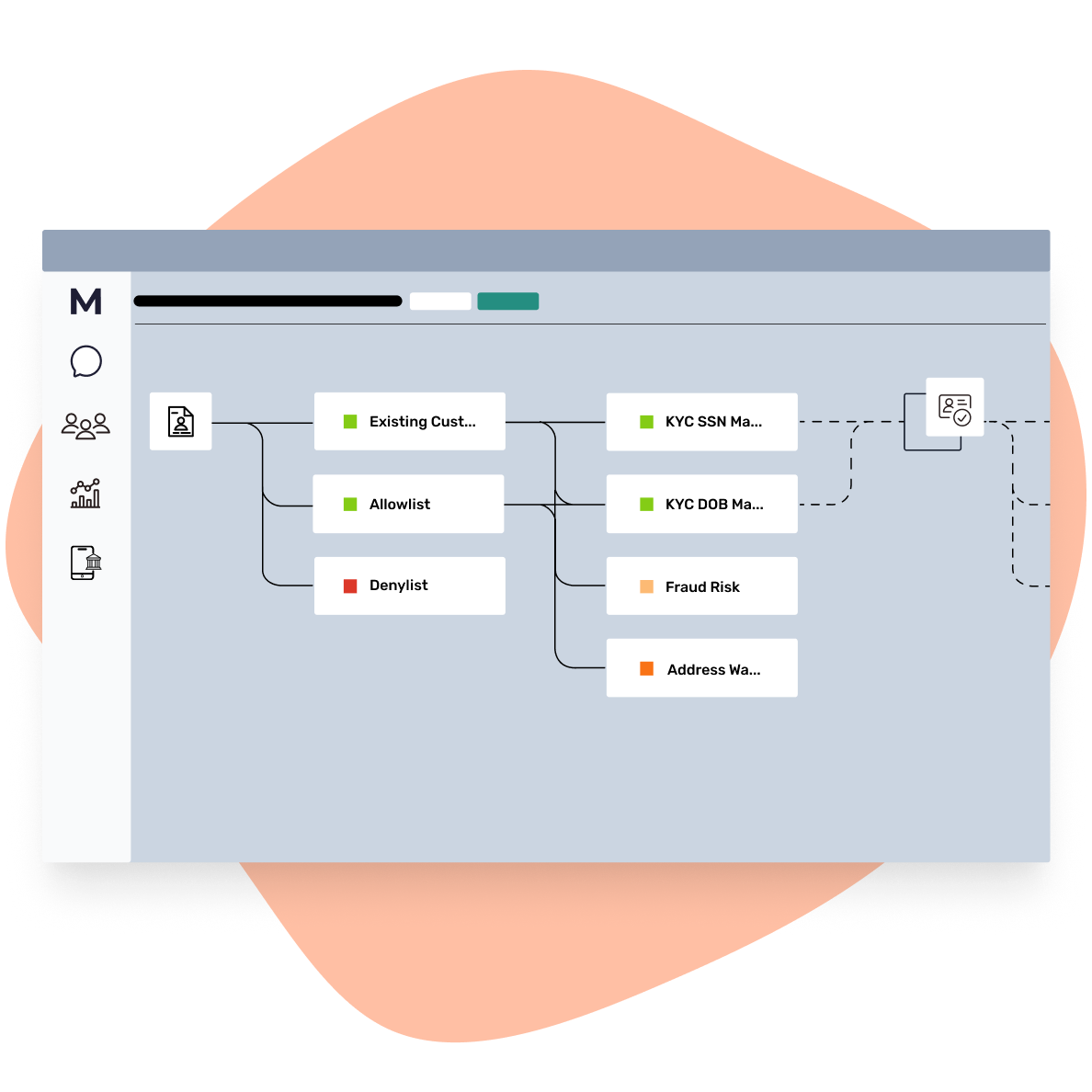

Adaptive Due Diligence

Powerful Data

Adaptive due diligence tailored to each business

Improve employee efficiency and maximize conversion, while minimizing fraud with configurable decisioning and adaptive due diligence

Tailored application requirements and products depending on the business

Configurable KYC waterfalls based on your unique risk strategy

Streamlined manual review process to increase employee efficiency

Data to drive you forward

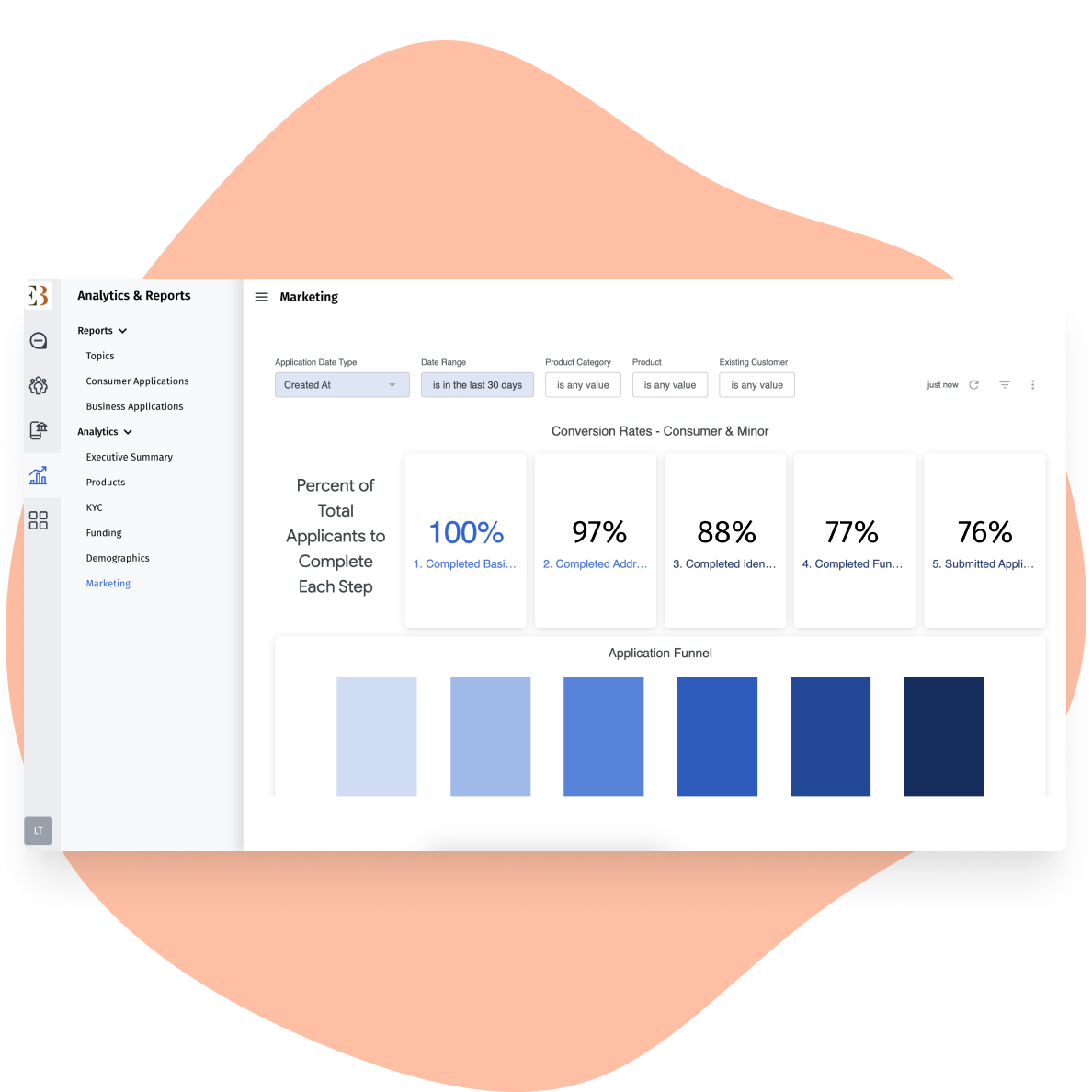

Make more informed and real-time business decisions with out-of-the-box reporting and analytics dashboards

Accessible data for branch performance, marketing optimization, product testing, and more

Simplified compliance and audit trails

Flexible access to data through API, SFTP, or Direct SQL

The power of omnichannel business account opening

Create synergy between your service channels

- Enable your call center staff to re-engage abandoned applications right where they left off

- Leverage fully online account opening for small businesses and sole proprietors to free up your teams time to focus on your most profitable accounts

- Remove the limitations of your branch footprint while maintaining your high-touch approach

More features to power deposit growth and customer satisfaction

Unified Deposit Origination

Meet every customer’s needs with diverse product offerings from a single point of entry

Audit Trails

Monitor your compliance program and improve regulatory exam preparation

Robust Integrations

Integrate with external systems including AML, OMB, and DMS providers

Real-time Core Integration

Modernize operations with real-time two-way syncing with any core

Digital Branch Manager

Easily add new products and customize your digital branch with no code configuration

Automated Emails

Increase engagement and conversions with precisely timed communications

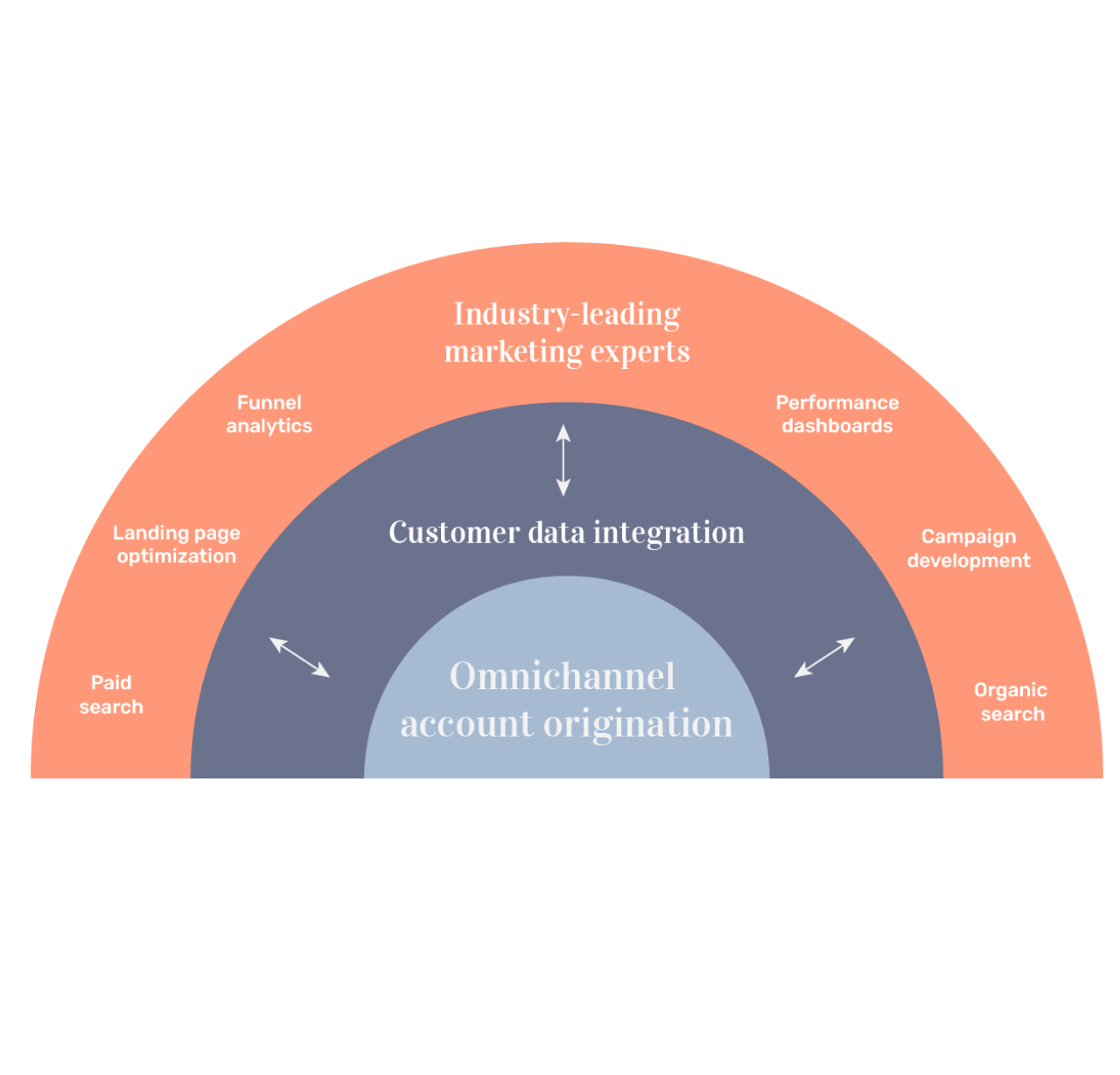

MANTL Growth Engine

MANTL Growth Engine pairs proprietary customer data and industry-leading marketing experts to effectively and efficiently achieve deposit goals at a lower cost