The industry’s most powerful growth engine

Drive consumer and commercial deposits and loans anywhere, anytime with one front door for account origination

REDEFINING GROWTH FOR FORWARD-THINKING INSTITUTIONS

MANTL FOR BANKS

Seamless origination anywhere, anytime

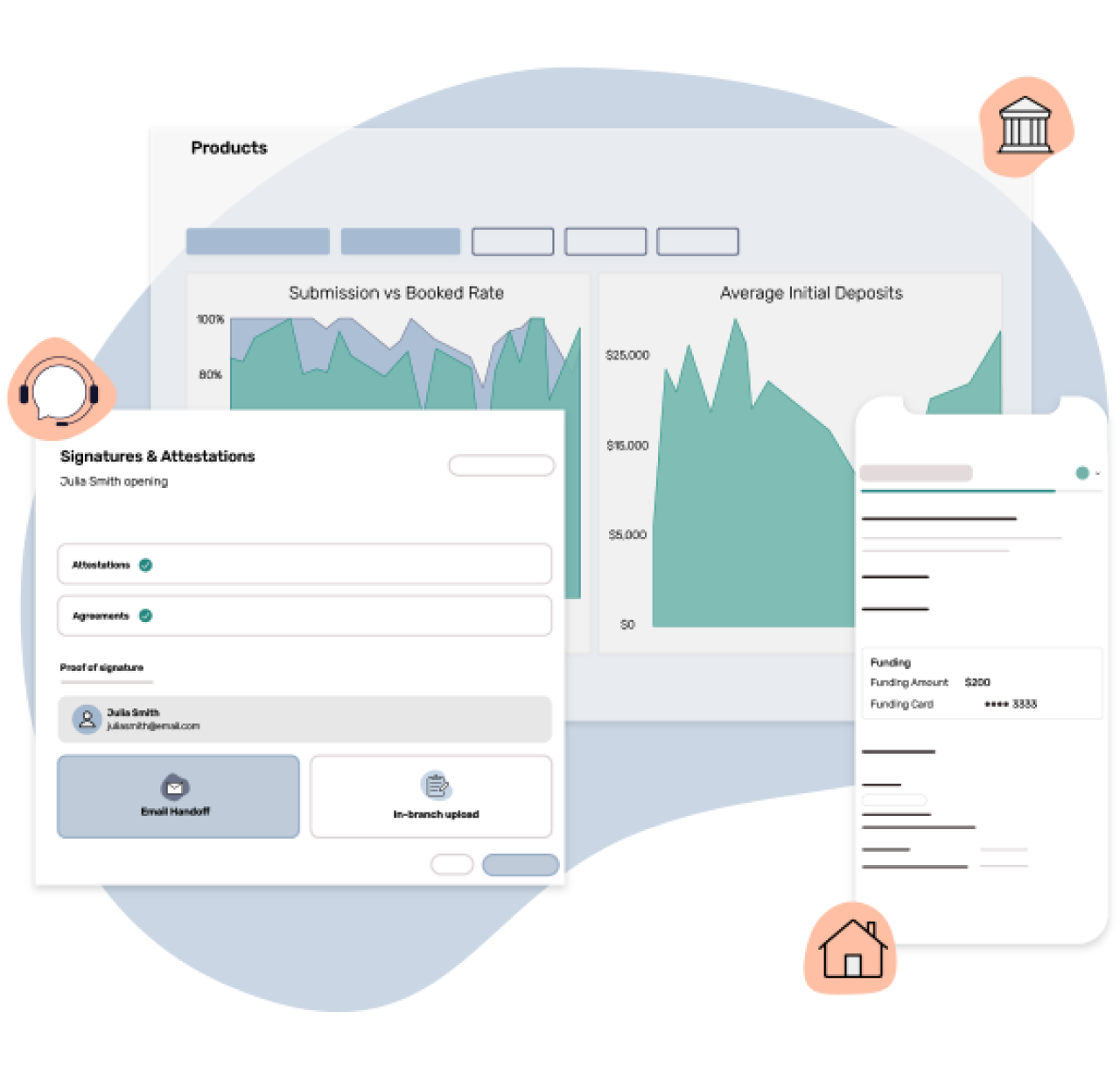

MANTL’s Omnichannel Account Origination bridges the gap between online and in-branch, facilitating the seamless flow of information across channels

The simplest and most efficient way to grow consumer deposits

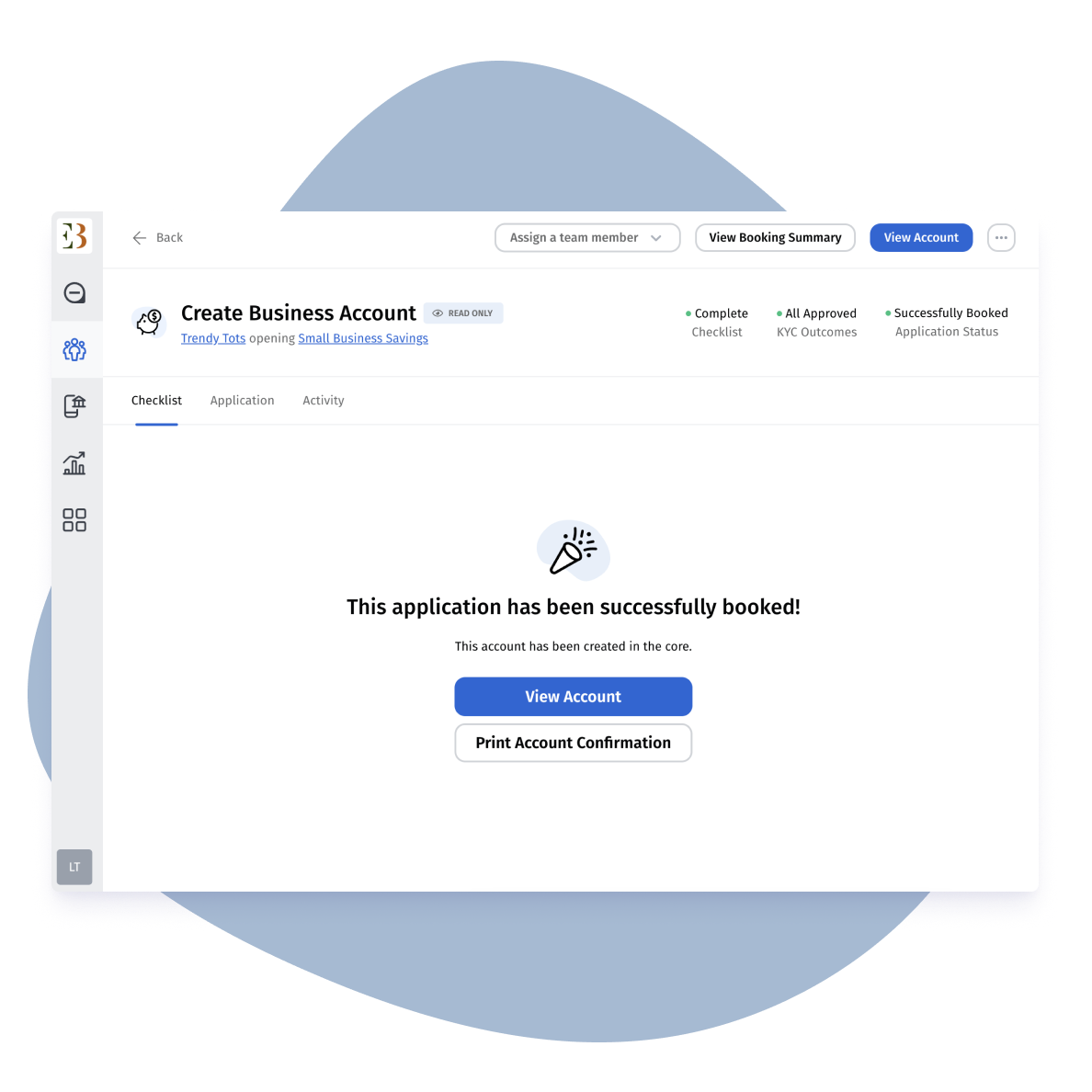

Learn MoreBuilt for business, geared for growth

Learn More

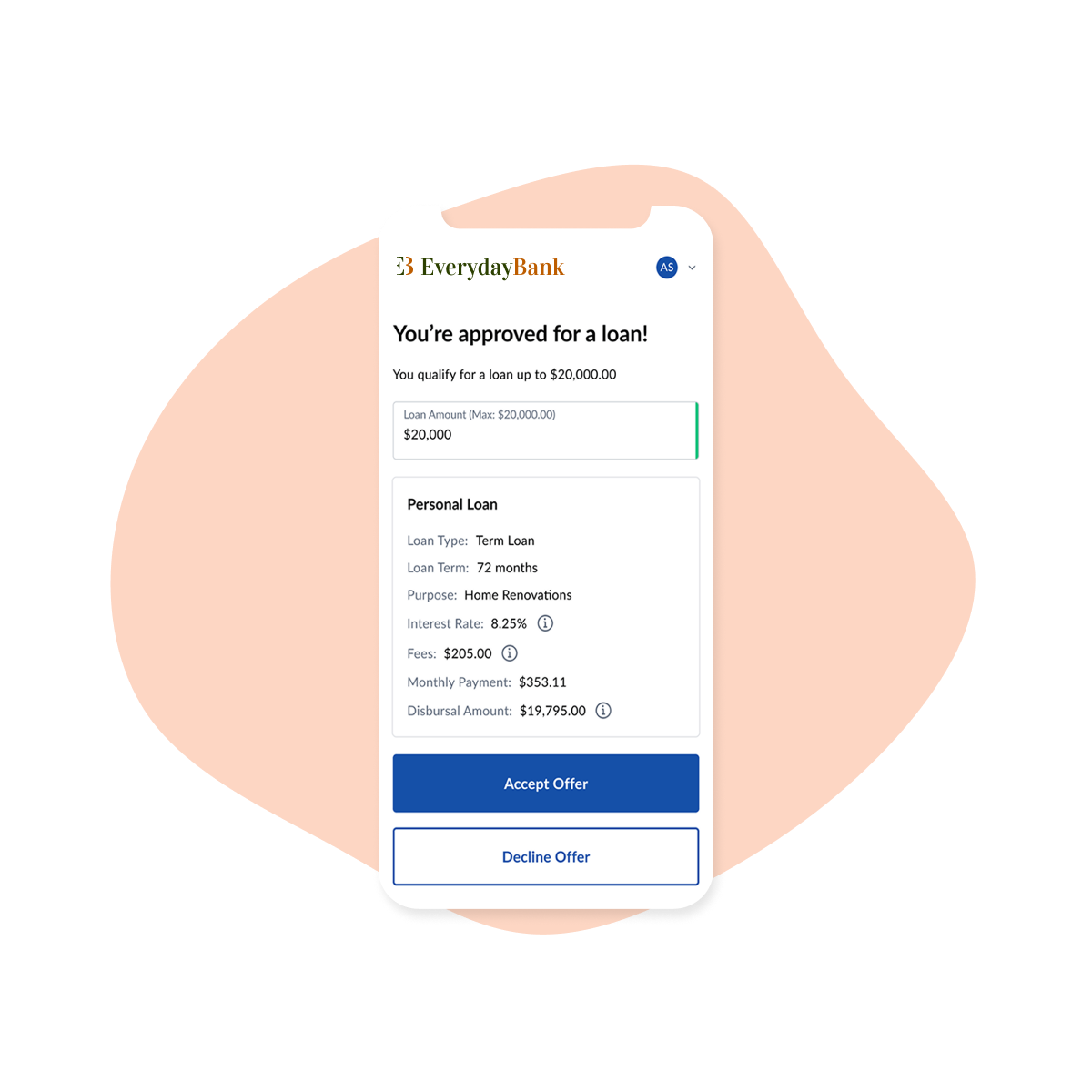

Scalable loan origination starts here

Learn More

MANTL FOR CREDIT UNIONS

World-class member experience delivered

MANTL’s Omnichannel Account Origination transforms member and employee experience by bridging the gap between online and in-branch channels

Member-first deposit growth starts here

Learn MoreEmpower your team to deepen business relationships

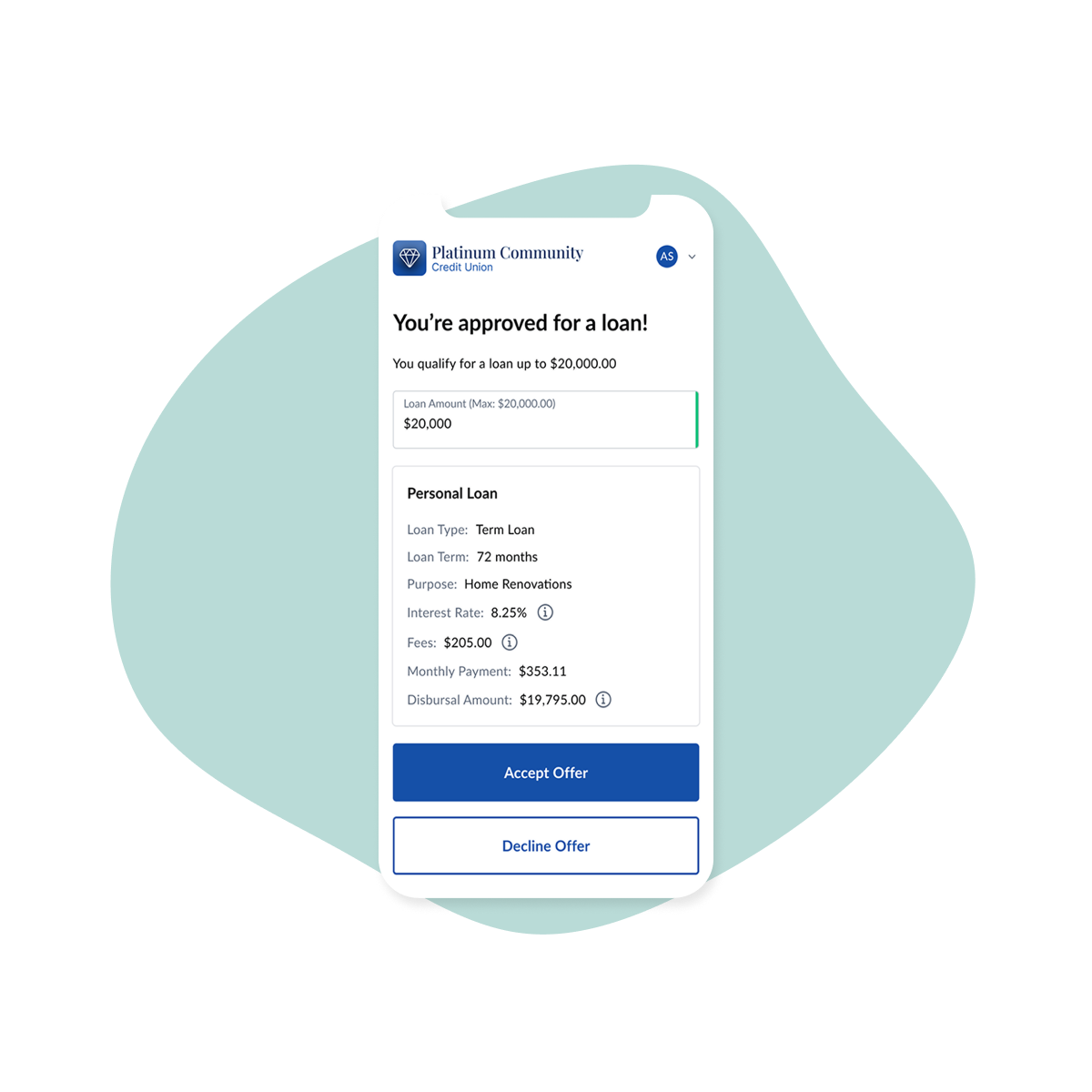

Unify loan and deposit origination for a superior member experience

Learn More

Accelerate deposit growth

Transform branches

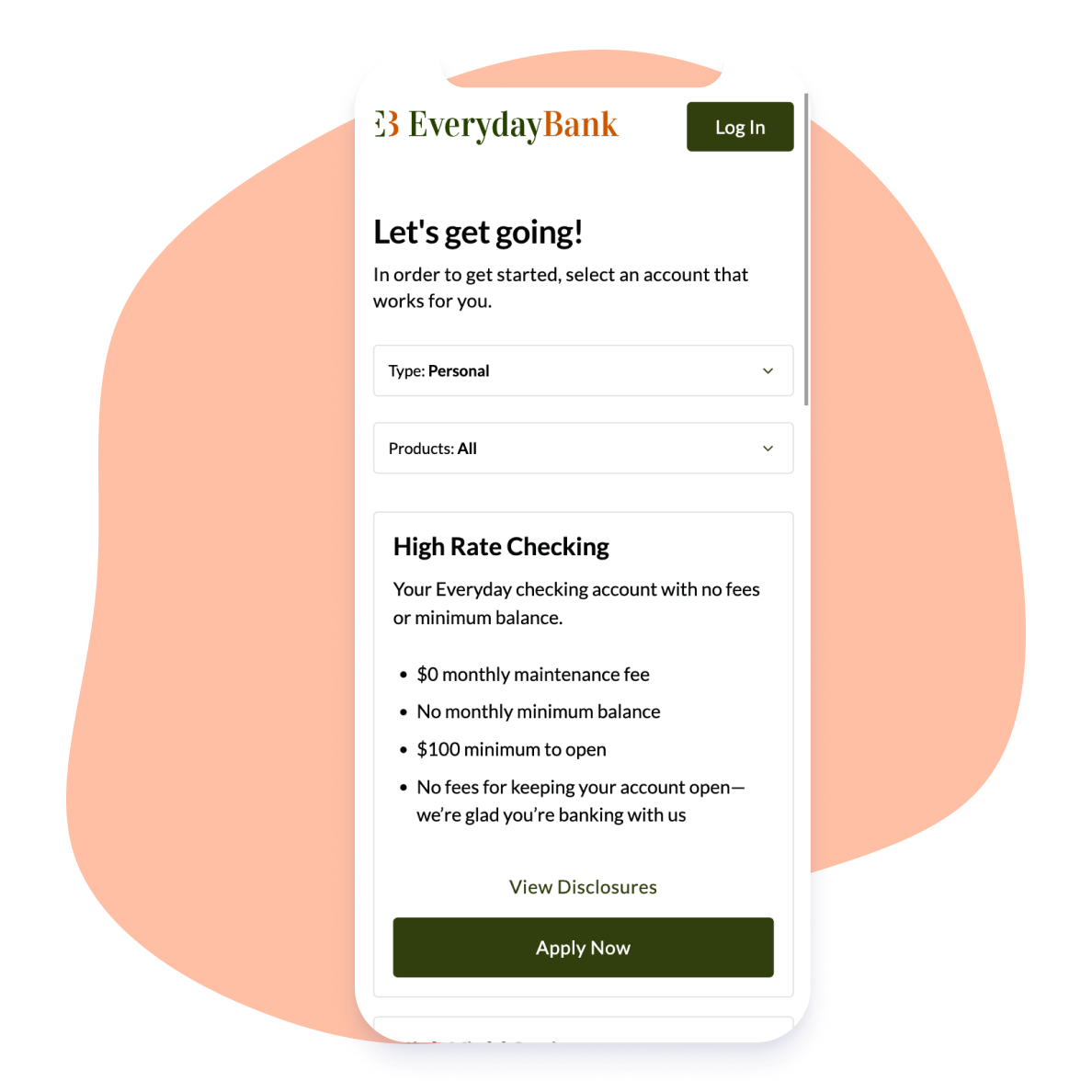

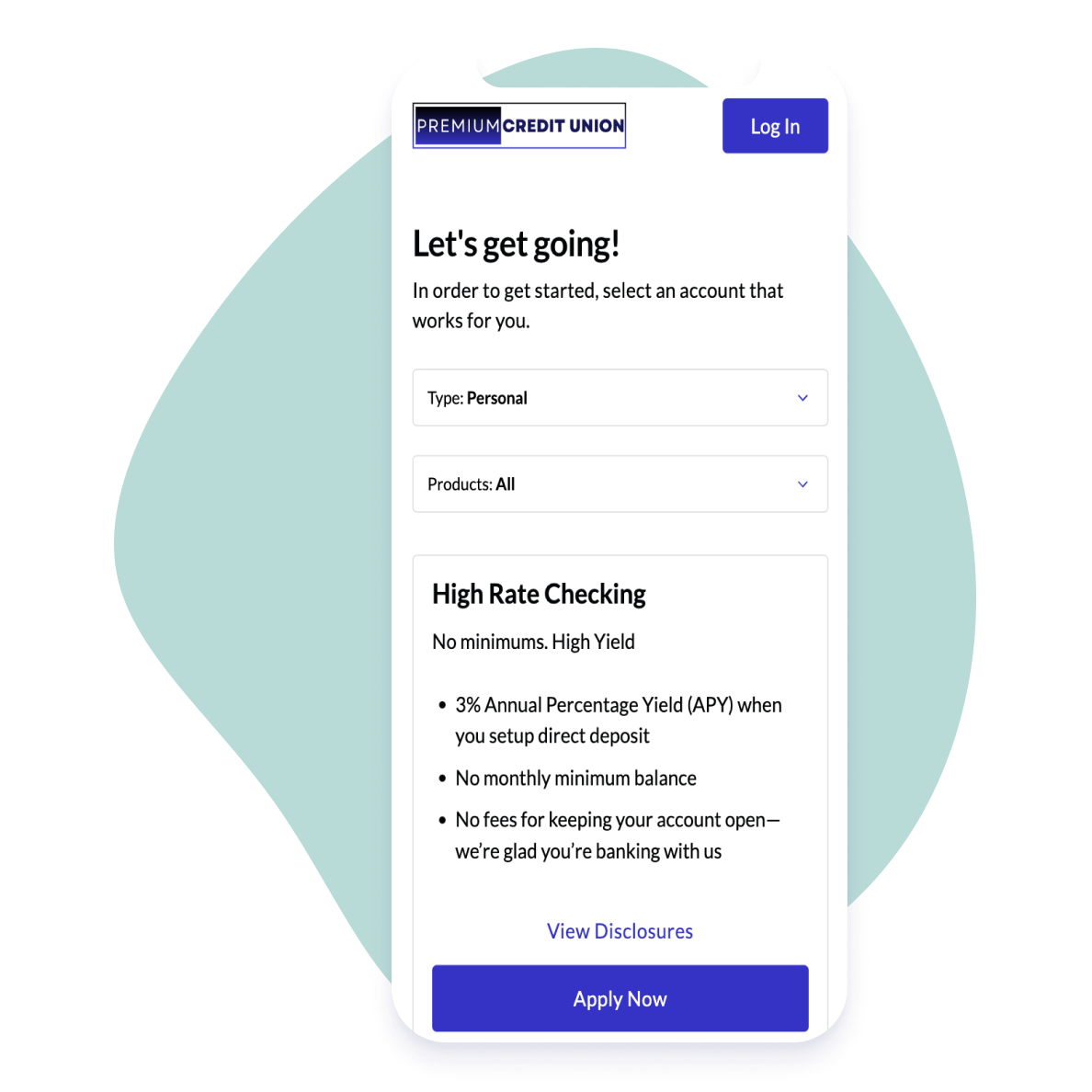

Launch a digital brand

Acquire new members

Achieve explosive consumer and business deposit growth

Acquire core deposits and reduce reliance on wholesale funding

Grow existing customer value with streamlined cross-sells

Optimize growth while mitigating fraud with industry-leading controls

Give your branches the technology upgrade they deserve

Spend more time growing accounts and fulfilling your customers’ unique banking needs

Maximize the impact of your branch staff with digital account onboarding

Streamline front and back office communication to improve branch operations through premium banking technology

Expand your product offerings and break into new verticals

Launch and market new product offerings outside your legacy brand

Unlock new market segments and expand your geographic footprint without requiring a physical branch

Offer differentiated rates and products for each of your digital brands

Supercharge the growth of your member base – in and out of your existing markets

Streamline applications and eligibility verification to increase conversion, while mitigating risk

Offer frictionless account opening and share creation for new members

Expand your reach beyond your physical footprint with high-performing banking technology

INTEGRATIONS

Connect your systems into a powerful growth ecosystem

Seamlessly and securely integrate your origination solution with your evolving tech stack