Customer Identification Program or “CIP” is a nationwide legal and regulatory framework established by the USA Patriot Act. It is interchangeably and colloquially referred to as “Know Your Customer” or “KYC”.

The regulatory framework underpinning CIP was implemented in 2003 by the Financial Crimes Enforcement Network (FinCEN), Office of the Comptroller of the Currency (OCC), the Board of Governors of the Federal Reserve System (FRB), the Federal Deposit Insurance Corporation (FDIC), the Office of Thrift Supervision (OTS) and the National Credit Union Administration (NCUA), which collectively account for the primary regulatory bodies of the United States financial system.

These regulatory bodies jointly adopted and implemented the banking regulation framework established in law by section 326 of the Patriot Act, with the primary aim of improving the transparency of the US financial system and stopping the funding of terrorism.

The CIP regulatory framework also incorporates and interrelates with obligations under the Bank Secrecy Act or “BSA.” All of these terms are used interchangeably.

Can I satisfy Customer Identification Program requirements without collecting physical documents?

Yes. Both the Federal Financial Institutions Examination Council (FFIEC), a body which consists of all the primary regulators, plus the Consumer Financial Protection Bureau (CFPB) and FinCen have standing guidance allowing non-documentary based customer identification programs.

Specifically, the current FFIEC (page 643) states:

“Banks are not required to use nondocumentary methods to verify a customer’s identity. However, a bank using nondocumentary methods to verify a customer’s identity must have procedures that set forth the methods the bank uses. Nondocumentary methods may include contacting a customer; independently verifying the customer’s identity through the comparison of information provided by the customer with information obtained from a consumer reporting agency, public database, or other source; checking references with other financial institutions; and obtaining a financial statement.”

In-fact, the guidance allows for banks to choose document based, non-document based or a combination of both methods in their customer identification programs with the stipulation that the program “must describe when it uses documents, nondocumentary methods, or a combination of both.” (page 49)

How can I use nondocumentary methods to improve outcomes?

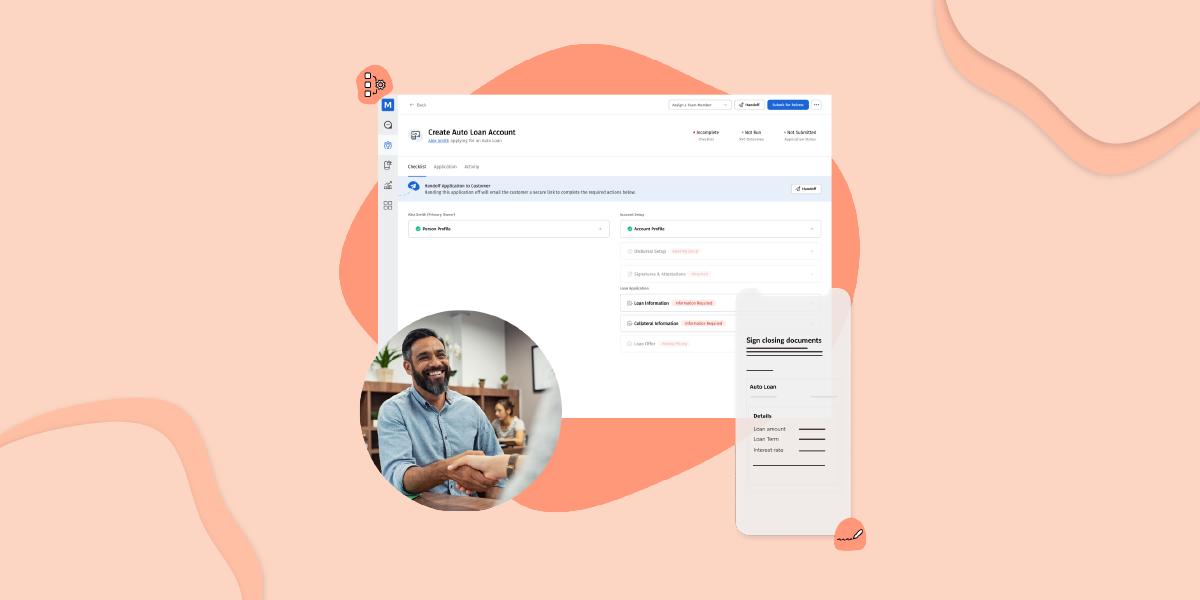

Recent technology improvements have made it possible for banks and credit unions to comply with regulatory requirements while automating most manual back-office tasks. With modern technology, financial institutions are able to improve outcomes without utilizing documentary methods to verify customers’ identity and still comply with regulatory requirements.

The best online account opening software solutions offer the ability to check a customer’s identity and real-time and allow teams to update and improve BSA/KYC/AML decision waterfalls on a regular basis. That way, compliance teams can constantly evolve their best practices to assess risk, adapt to changes in the regulatory environment and reduce fraud.

MANTL offers robust tools for verifying identity online, preventing fraud, and meeting your bank’s regulatory obligations, according to your BSA team’s approach. We’re here to help.