During the COVID-19 crisis, banks have adapted to disruption by leveraging digital tools and finding new ways to serve customers.

For community banks, the COVID-19 crisis has made it clear that resilience means being prepared to pivot during unanticipated disruptions. Even as circumstances change in unpredictable ways, banks must not only ensure operational continuity but also leverage potential opportunities as they arise.

When it comes to prepping for disasters, community banks have typically centered their plans around preventing threats related to physical branches, or moving operations from one physical location to another. But today’s new normal is very different from that of the past ten years. Unlike many previous recessions, the current economic situation did not originate in the financial sector, but through a global pandemic that upended everyday life and impacted supply and demand at unprecedented levels.

COVID-19 has forced banks to shift their strategies and consider alternative ways to serve customers beyond brick and mortar locations. Strategic digital banking transformations enable banks to embrace flexibility, ensuring they can offer customers new solutions and continue to work toward institutional goals, even during challenging times.

Midwest BankCentre is an example of a community bank that has refocused its strategy to successfully serve its customers during the pandemic. By leveraging its digital branch and raising funds for PPP loans, Midwest BankCentre has been able to exceed its annual deposit goals.

Midwest BankCentre shows resilience

Midwest BankCentre is a 113-year-old community bank with 19 physical branches and a national digital branch, Rising Bank, launched in 2019. Based in St. Louis, Midwest BankCentre has about half of its physical locations placed to serve low- or moderate-income areas, while Rising Bank offers digital banking innovations, including competitive CD and savings rates, to customers across the country.

When the pandemic hit, the bank’s existing risk management plan had not anticipated the many nuances of COVID-19. Nonetheless, the bank was able to pivot its operational strategy and quickly move staff to a remote effort, with about 85 percent of employees working remotely while branches provided some drive-through services and appointment-only services in the lobbies. At the same time, the bank supported its employees through training and engagement to make the shift to remote work as positive of an experience as possible.

With these changes came a new focus on digital banking trends, though Rising Bank had not necessarily been founded with this kind of resilience in mind. As Dale Oberkfell, President & CFO at Midwest BankCentre, explained, “Rising Bank primarily provided an opportunity to expand our customer base, to learn how to do business within a younger demographic.”

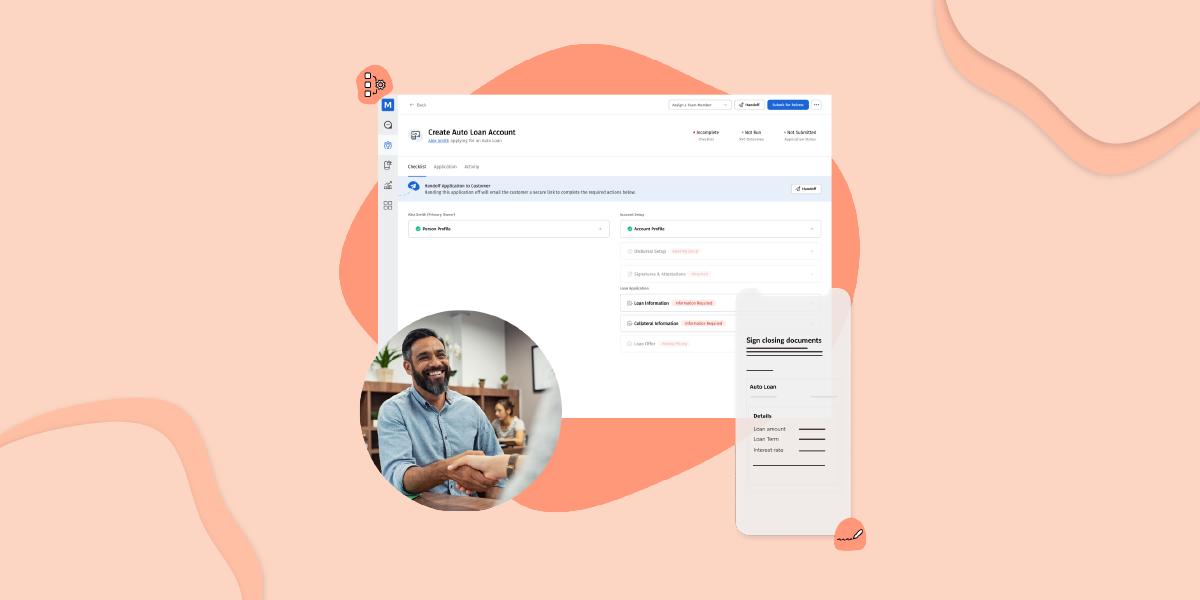

However, Rising Bank now appeals not just to younger customers but to the many customers at home who need a digital banking solution. By offering a well-designed and flexible customer experience, Rising Bank has become a more critical asset than ever. Rising Bank uses MANTL’s digital account opening software, which seamlessly integrates new accounts with the bank’s Silverlake Core Banking System, making the process easier for both staff and customers.

In fact, the launch of Rising Bank has helped Midwest BankCentre foster a culture that is welcoming to change. Often when launching a digital channel, bankers are concerned about its effects on branch employees’ morale and engagement. However, Midwest BankCentre proves that with proper training and incentives, a bank can leverage both digital and physical channels in a complementary way to achieve operational efficiencies as well as maintain high levels of employee morale and satisfaction.

Growing funds for PPP loans

In addition to surviving the pandemic, Midwest BankCentre has managed to exceed its goals for 2020. With streamlined account opening, Midwest has grown to $160 million in deposits in 45 days, past its original goal of $100 million in annual deposits. To reach a similar goal, a community bank might have to launch ten new physical branches, with the many related expenses, and hope to grow each branch to perhaps $50 million in deposits over five years.

A part of this success arose from the Paycheck Protection Program, which tasked banks with delivering government relief funds. In April and May 2020, Midwest BankCentre booked over 1,200 PPP loans, totaling about $200 million in loans. Typically, its annual loans are about $100 million a year, so this growth over just 45 days was unprecedented. At the same time, the PPP experience gave the bank the opportunity to forge deeper relationships with its commercial customers.

Midwest BankCentre demonstrates that resilience isn’t about just surviving hard times, it’s also about adapting to new circumstances, finding ways to succeed, and looking forward to the future. Thanks to its recent earnings, Midwest BankCentre is now planning to make strategic investments in further technological upgrades, in order to develop more efficient workflows and digital tools that provide both staff and customers with new, exciting solutions.

Digital finance technology offers flexibility

The recent crisis has shown that resilience requires operational flexibility — and it’s clear that digital banking tools can help community banks adapt and thrive. The COVID-19 crisis only accelerated existing digital banking industry trends, much like the ongoing shift in retail transactions from brick and mortar stores to a hybrid model that includes both physical locations and e-commerce sites. As customers form new habits, these changes are likely here to stay, creating opportunities for banks moving forward.

“I think it’s really important that community banks recognize that they can successfully do business in both the digital space and face-to-face,” explained Dale Oberkfell, “because that’s what distinguishes us.” Physical branches will continue to play an important role in enhancing the customer experience. But digital channels are ultimately what will allow banks to convert new customers as quickly and efficiently as possible, expand the bank’s footprint, and deliver services to people when, how, and wherever they want to engage.

COVID-19 has upended people’s lives in many ways, including how they interact with their banks even after branches have started reopening. Banks that are investing in technology and approach digital channels as a complementary service — not a source of competition — to their physical branches are coming out ahead.

Investments in technology can ensure that community banks outlast the current crisis and others that may arise in the future. Wide-reaching global events like COVID-19 will come and go, so it’s important for banks to start building resilience and thinking “outside the branch” now. With MANTL, your digital bank can be up and running in just 90 days.