Learn what it costs for community institutions to acquire new customers—whether through opening and operating a new branch or investing in best-in-class digital tools.

Key insights:

- The number of bank branches across the U.S. has declined by 25%+ since 2009.

- Digital channels offer efficiency and growth potential, improving individual branch value and reducing the need for additional branches.

- Compared to building a branch, online account opening is a less costly and more effective way to acquire new customers.

How much does it cost to acquire new customers? This is one of the most important questions for any financial institution, yet the answer can vary widely depending on the channel.

Customer acquisition cost (CAC) is a complex metric, including all steps from building awareness to nurturing leads to converting prospects. In this article, we’ll examine the relative efficiency of digital and physical channels so you can make the best choice according to your institution’s goals.

The number of physical bank branches in the U.S. peaked in 2009 at about 36 branches per 100,000 adults. Since then, banks have been closing branches, causing that number to drop more than 25 percent. In fact, banks have closed 3,324 branches during the last year alone. Branch closures for credit unions are not quite as high, but The Financial Brand reports a loss of 400 branches from June 2019 to June 2020.

In addition to the growth of digital channels, another reason behind branch closures is that brick-and-mortar branches are expensive to open and operate. Even once they’re up and running, it can take years to break even. Banks typically invest about two to four million on average to open a new branch. Branches then cost an average of $400,000 per year to operate, though costs can reach up to $700,000 per year in urban areas.

What is the CAC of brick-and-mortar branches?

Brick-and-mortar branches are also slow to turn a profit. According to an Oliver Wyman report, a community bank branch in the St. Louis, MO market could expect to raise $20 million in the first year, growing to $50 million after three years. At this rate, the branch could take years to break even, all while requiring four to five FTEs to manage day-to-day operations.

How can community institutions continue to grow even as physical branch numbers shrink? One strategy is to supplement existing branch networks with high-performing digital solutions. This omnichannel approach, in which digital and brick-and-mortar resources work together to serve customers, has the potential to expand the footprint of each branch, grow accountholders, and improve employee efficiency.

This omnichannel approach, in which digital and brick-and-mortar resources work together to serve customers, has the potential to expand the footprint of each branch, grow accountholders, and improve employee efficiency.

Here’s why digital banking works

Consumers today consult an average of nine different sources of information over a 60 to 90 day period when shopping for a financial product. Most of this research occurs digitally. Therefore, it’s vital for your institution to have a user-friendly and brand-consistent online presence. In particular, new customers or members should be able to easily open an account online.

Online account opening (OAO) enables banks and credit unions to acquire a much higher volume of new accounts from a wider geographic range than they could through branches alone. With OAO, your institution should expect to open 20 percent or more of all new accounts online. For many community institutions, that’s better than their best-performing brick-and-mortar branches. Plus, since a physical branch costs millions of dollars to set up and run, it makes strategic sense to grow your brand by implementing more efficient digital tools.

How to spot a low-performing solution from a high-performing one

OAO is often the first interaction a consumer will have with your institution, so it’s important to make it count. In particular, it’s key for your OAO platform to be fast and easy to navigate. A high-performing solution will minimize the time and number of steps it takes to open an account digitally. To accomplish this, the best OAO platforms offer:

- A sub-three minute application experience

- Automated KYC and ID verification capabilities to minimize delays due to manual application review

- Instant account verification (IAV) to speed up the funding processes while reducing the risk of fraud

- The ability to save and resume an application at the applicant’s convenience

These measures can help your institution reduce customer churn and lower CAC in the long term. In fact, with the ability to onboard more customers in less time, OAO and other digital tools can reduce branch density by 15 percent for banks and 34 percent for credit unions—with no drop-off in customer satisfaction.

Discover the most cost-effective way to acquire new customers

If you compare the expense of opening a new branch to that of implementing digital account opening, it’s clear which one is more cost-effective. Not only is onboarding new customers with digital tools more affordable, it also helps community institutions meet consumers where they are, thus improving customer satisfaction.

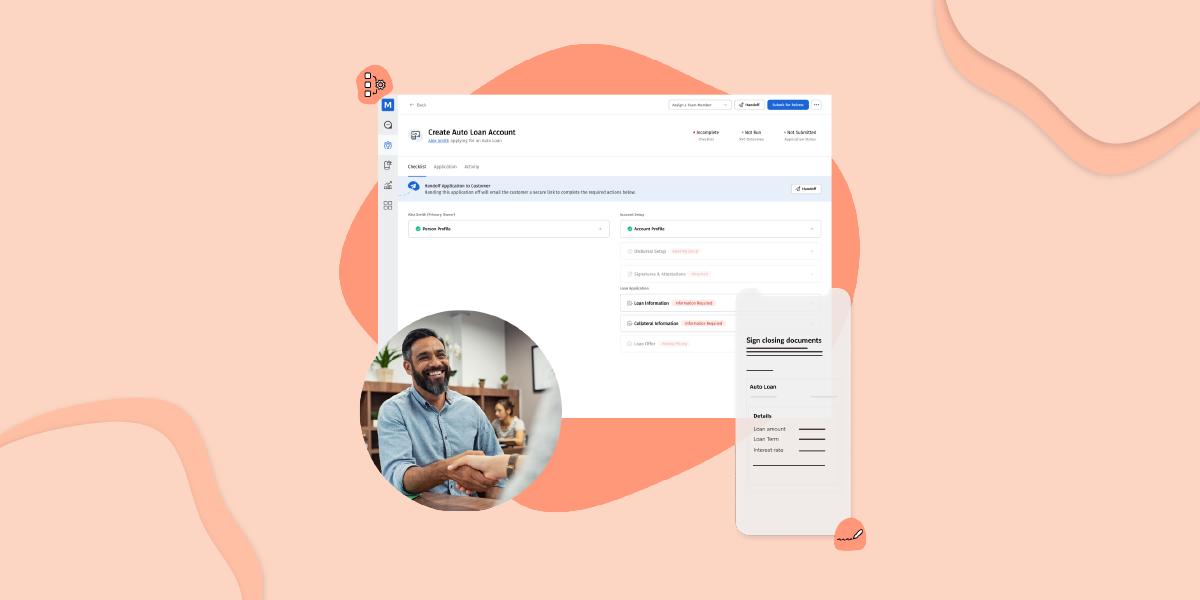

Ultimately, tools like MANTL offer banks and credit unions a shortcut to reduce CAC, boost digital presence, and make the most of every marketing dollar. To discover an OAO solution that can onboard customers in three minutes or less, schedule a demo with MANTL today.