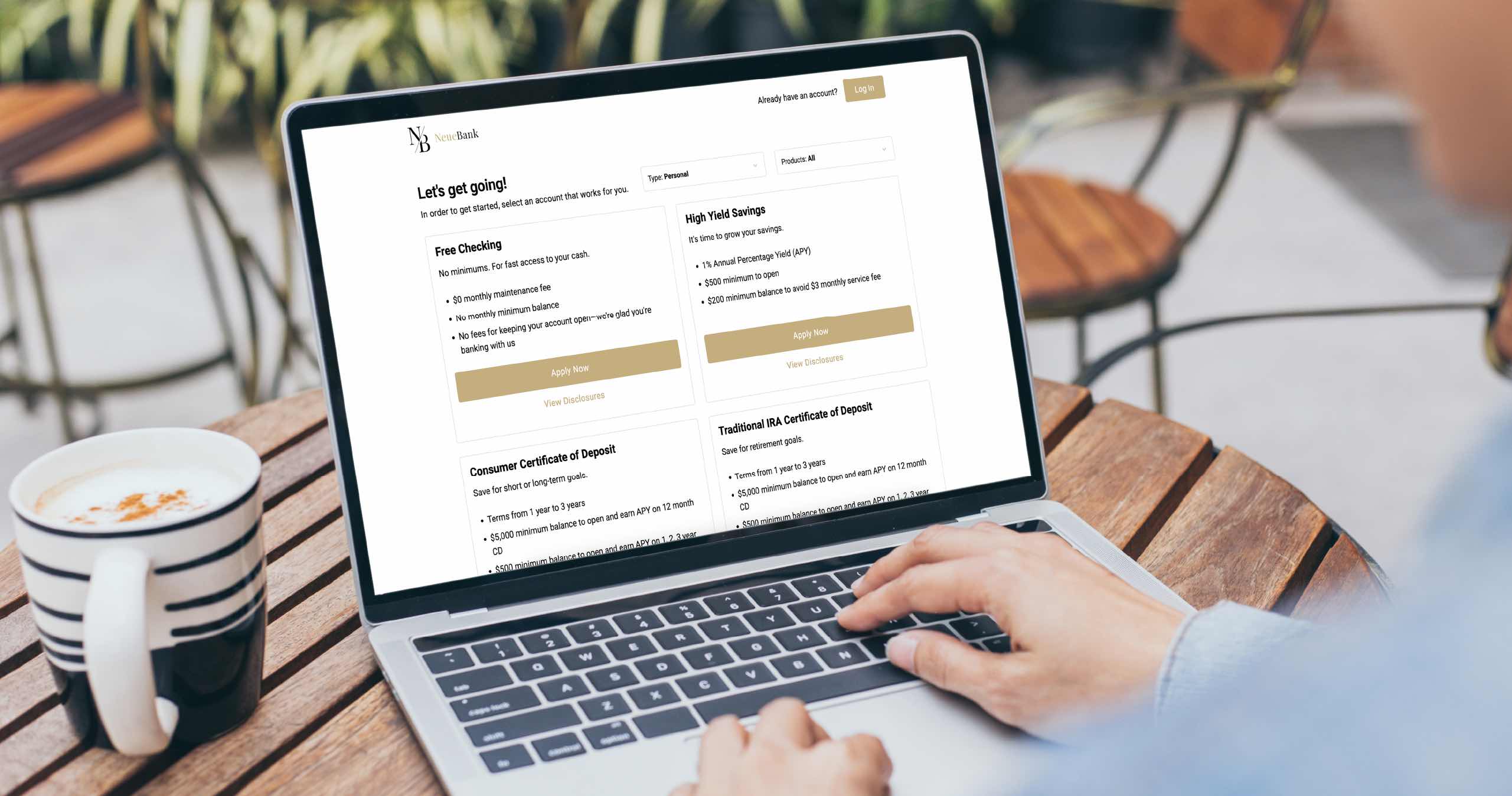

What if you could grow deposits and account holders while achieving a better efficiency ratio and delivering best-in-class customer and employee experiences? What if you could ensure consumer and commercial customers could open an account anywhere, anytime without always requiring manual intervention?

This is all possible when online and staff-led channels (i.e. branches, call centers, personal bankers) work together to create a scalable omnichannel experience that meets the customer wherever they are. An efficient digital channel allows financial institutions to meet the needs of their existing customers and unlocks opportunities for market expansion and new product launches. Additionally, having a modern and streamlined staff-led experience is essential for building deep relationships and trust – an efficient branch increases customer lifetime value and employee satisfaction.

MANTL unlocks the ability to optimize efficiency, expand reach, provide a better customer experience, and also drive down the costs of funds. With MANTL, financial institutions can generate greater ROI via marketing efficiencies, operational efficiencies, KYC automation, and lower fraud, while limiting the need for costly wholesale funding.

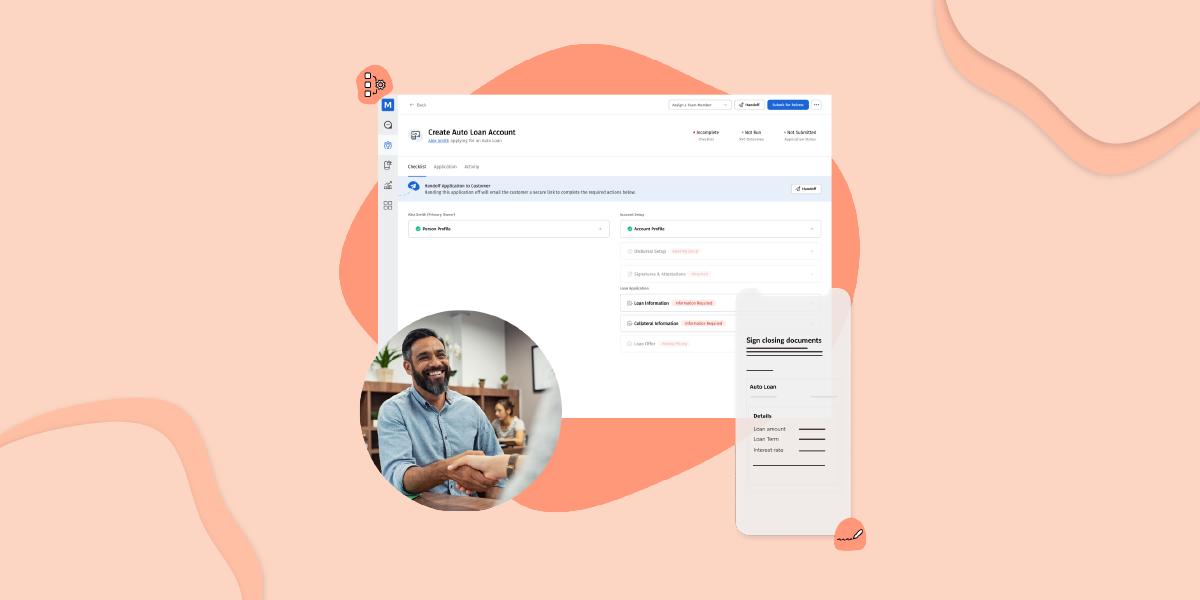

MANTL’s Omnichannel Account Origination bridges the gap between online and person-to-person, facilitating the seamless flow of information across channels. Applications are securely updated across devices and channels in real time, enabling bankers to engage with customers where they are, using whatever channel they prefer, precisely when their input is needed. Omnichannel account origination increases application conversion, optimizes operational efficiency, and improves customer satisfaction.

MANTL leverages automation to eliminate manual tasks and improve efficiency

- More than 90% of MANTL application decisions are automated. High decisioning automation reduces the number of applications requiring manual review and frees up staff time to focus on higher value initiatives and customer relationship building.

- MANTL customers see a 67% reduction in fraud. MANTL leverages best-in-class data providers to reduce fraud while maximizing verification automation, with configurable decisioning and adaptive due diligence.

MANTL enables financial institutions to serve customer with every needs from simple consumer savings accounts to complex business

- Account Origination for numerous products under one platform allows for seamlessly maximizing wallet share with cross-sells.

MANTL provides a truly omnichannel solution that bridges the gap between online and in-branch for superb customer experience

- Omnichannel Account Origination bypasses the geographic limitations of branches with complimentary online offerings that extend beyond the reach of a branch.

- MANTL enables applicants to complete an application across multiple channels, such as web, mobile, and in-branch, which is particularly useful for complex businesses, joint accounts, and more complex financial products.

- Providing a frictionless account opening process enables financial institutions to attract and retain more customers.

MANTL offers a best-in-class employee experience

- Intuitive banker technology that leverages automation reduces manual tasks and allows bankers to focus on more high value initiatives and win more business.

- Automated attribution ensures bank employees receive credit for the applications they work on.

MANTL is a proven and trusted high-performing technology platform

- With a true multi-tenant SaaS platform, MANTL delivers reliable, scalable, and configurable technology. Updates and improvements are made weekly to provide new functionality and improve the platform overtime.

- MANTL’s consistent and reliable uptime ensures continuous user access and data security.

MANTL empowers financial institutions to grow deposits efficiently and effectively. With MANTL, Financial Institutions can reach their business goals while providing an exceptional customer and employee experience.