Community banks and credit unions provide key financial services, in many cases giving underserved communities a chance to join the financial system.

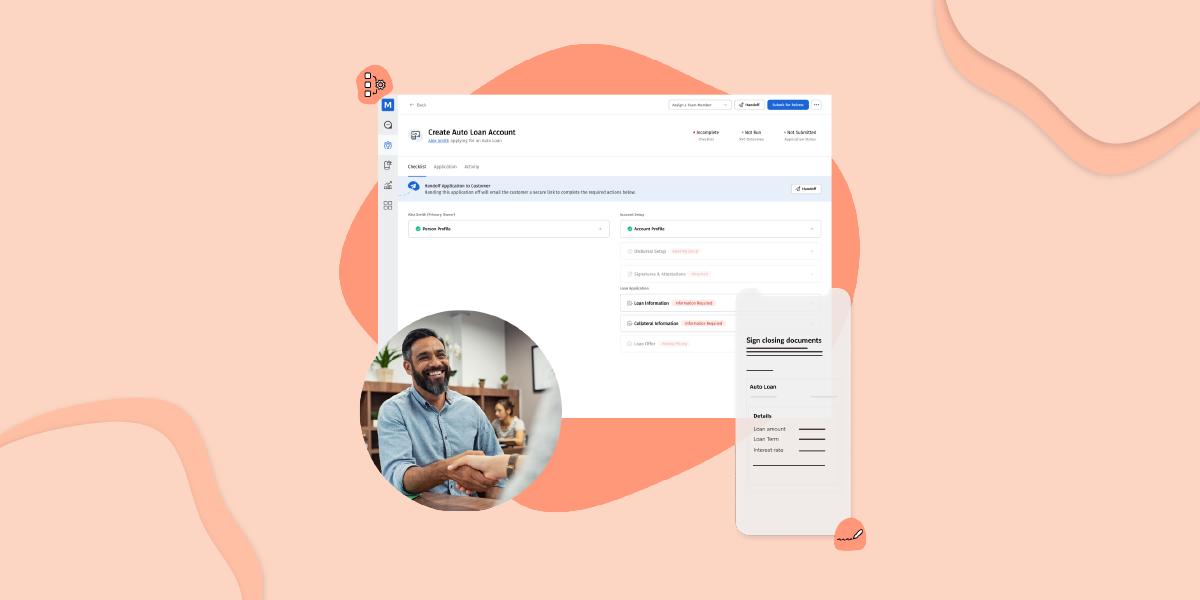

At MANTL, our mission is to build platforms that help community institutions and their respective communities thrive. We are passionate about designing ways to make the financial system more convenient and inclusive. Community banks and credit unions that use MANTL gain not just a streamlined, safe, and highly effective tool, but one that breaks down unnecessary barriers of entry.

Non-documentary verification removes barriers

For low-income and immigrant households, lacking a physical ID can be a major obstacle to opening an account. In fact, banks that require a driver’s license in their application flow typically see conversion rates drop by about 15 percent — and for low income areas it can be even higher. Target customers for a community institution like Quontic Bank in New York are likely to abandon the digital account opening process altogether if a friction point such documentation requirements arises.

To solve this problem, MANTL’s onboarding process is designed to use non-documentary verification methods, which means our system draws from over 30 data sources for real-time digital verification. Banks therefore don’t need to ask for state ID unless there isn’t sufficient online KYC information to meet Bank Secrecy Act (BSA) requirements.

This method may be new to some financial institutions. But in fact, primary regulators within the Federal Financial Institutions Examination Council (FFIEC), as well as the Consumer Financial Protection Bureau (CFPB) and FinCen, have standing guidance for non-documentary customer identification. MANTL’s robust tools combine your BSA team’s approach with our best practices to ensure regulatory obligations are met without driving away customers.

At Quontic Bank, for instance, the compliance team found that MANTL’s data-based methodology, combined with top-of-the-line fraud prevention tools, best fit their criteria for a safe and inclusive banking solution. With MANTL in place, Quontic Bank has had 58 percent of applicants make it through to submission in the first five months — compared to conversion rates of 20 percent and 45 percent with its previous two systems.

Automated decisioning minimizes bias

Human bias touches every industry, and banking is no exception. Unfortunately, people of color and women are more likely to be perceived as financial liabilities. For instance, lenders deny mortgages for Black applicants at a rate 80 percent higher than that of White applicants, according to 2020 data from the Home Mortgage Disclosure Act. At the same time, banks in black neighborhoods typically require higher account balances — on average $245 higher — to avoid service fees.

Women don’t fare much better — they are less likely to be approved for mortgages and other retail credit, despite often having near-identical FICO ratings. Consumer loans to women average 32 percent lower than those made to men, with interest rates 15 percent higher.

Fortunately, technology can help address these disparities by relying on waterfalls to automate customer evaluations and decision-making. At MANTL, we automate an average of 92 percent of evaluations, reducing manual reviews and the potential for unconscious biases. (At Quontic Bank, the automatic decisioning rate is as high as 97 percent.)

Of course, no algorithm is fully objective. But at MANTL, we are committed to developing our products with inclusion in mind, so that our data and tools can truly minimize common biases. Plus, our automated decisioning capabilities aren’t just convenient — they also help safeguard institutions.

Digital banking opens doors nationally

In this day and age, many customers lack the time and means to visit a physical bank, especially during operating hours that may coincide with work hours. Further, nearly 58 percent of customers across all demographics report that they have been visiting bank branches less frequently due to the COVID-19 pandemic.

Fortunately, digital solutions can help expand accessibility to banking services. In fact, 44 percent of customers say they have increased their usage of mobile banking services since the pandemic began.

When it comes to low-income customers, Americans in households earning less than $30,000 per year are more likely to own a smartphone than a computer. Given the needs of these customers, mobile solutions could be the key to making banking services more accessible. Similarly, rural populations may lack access to a nearby bank, but mobile banking can provide them with an effective and easy experience regardless of geography. In fact, 87 percent of customers in the heartland (rural communities) own a smartphone and are more likely to use mobile banking than their coastal counterparts.

Lowering onboarding costs changes the calculation

In many instances, the high costs of onboarding and servicing account holders means banking products are out of reach for low-income customers. MANTL’s online account opening software can help lower these operational costs by up to 50 percent. Our platform helps streamline internal operations so that community banks can process hundreds of millions in online deposits annually, with minimal overhead.

With a streamlined system, the calculation on potential customers changes — perhaps making it more financially feasible to welcome new types of customers or even give back to the community in other ways.

MANTL’s inclusive mission

At MANTL, we’re dedicated to facilitating a more inclusive, accessible financial system that works for everyone. With this mission in mind, we have designed our digital account opening process to not only be highly effective, but more equitable — built to expand access for customers of all backgrounds, reduce human bias, and allow banks to reach more customers across the country.