Consumers are most likely to try something new and change established habits during significant life events. In fact, 25% of consumers who consider switching checking accounts are driven by a life event, be it the birth of their first child or the move to a new home.

The retail industry has successfully leveraged consumer life events to influence their buying behavior, even before online browsing information and real-time behavioral retargeting were available to their marketing teams. Using their own customer data combined with 3rd party data overlay from external sources, retail companies have developed sophisticated models to identify and predict major life events way before they happen, from the simplest – milestone birthdays – to the most private – an imminent divorce – to personalize the message and increase conversion.

Using life events to acquire new checking customers and raise deposits

Traditionally, banks have done a decent job targeting customers during life events, primarily based on credit score and address change data from the USPS to drive new customer acquisition. But there’s one big problem with this strategy: the entire industry is doing it too! Customers are often bombarded with credit card and checking account offers when they update their address, which leads to extremely low response rates and high acquisition costs.

Although moving to a new home opens up a world of opportunities for increased consumption and habit change, that’s not the only relevant life event community banks and credit unions should be leveraging to target potential customers. Here are other significant life events that can trigger changes in consumer banking behavior and yield strong results from your acquisition efforts:

- College graduation and subsequent first full-time job

- Job change

- Higher education (Masters, Doctorate, Ph.D. programs) graduation

- Marriage

- Childbirth

- Divorce

- Retirement or late-career change

- Inheritance

How to target customers during a life event

Financial institutions have access to a wealth of valuable data from U.S. consumers: address and credit histories, income level and detailed spending habits, that they can leverage to effectively identify, target and convert the very best customers when they’re most likely to buy.

Unlike the investment industry, where past performance is no guarantee of future results, consumers are very predictable when it comes to their buying behavior, and their past consumption habits greatly predict future patterns. Take it from top retailers that use the concept of RFM (Recency, Frequency, Monetary value) of consumers’ previous purchasing behavior – whether it’s from their own offerings or from similar brands and even competitors – to score customers and predict with a high level of confidence their likelihood to purchase again.

Using programmatic advertising, you can automate the decision-making process of media buying by targeting specific audiences and demographics based on a combination of demographics, financial, RFM data to identify or predict life events that will greatly influence their likelihood to sign up for a banking product. Programmatic ads are placed using real-time bidding for online display, social media advertising, mobile and video campaigns, and is expanding to traditional TV advertising marketplaces. Any digital agency will offer programmatic bidding capabilities. The biggest challenge is to identify the right set of consumer data to optimize your targeting strategy.

Increase conversion during life events. Grow deposits

You’ve done your homework. You hired an agency to place programmatic ads and launched well designed, highly targeted ad campaigns but only with small improvements to your funnel conversion. Now what?

Too much emphasis is placed on top of the funnel acquisition: ad placements, copy and images to drive clicks to a website. However, developing an experience that helps consumers navigate the buying process with ease and closes the deal is often an afterthought. That’s where landing pages come in.

Effective Marketing campaigns should include specific landing pages that complete the funnel experience based on customers’ life stage. In many cases, the landing page is more important than the ad itself, because that’s where the real conversion happens. For example, if you’re targeting customers who are about to get married, your ads may promote joint accounts and your landing page should explain why joining finances will help the happy couple prepare for their future together. The landing page will do the heavy lifting to close the sale by helping the customer visualize a wealthier and happier future doing business with your bank. That level of personalization should not be executed on your homepage.

It’s tempting to send traffic from your ads straight to your homepage. That’s the easiest and fastest way to run ad campaigns, but also the most inefficient. Surprisingly, 50% of U.S. businesses run online ads without building specific landing pages, leaving billions of dollars on the table from lost conversions.

Bring customers back through retargeting

Retargeting, also known as remarketing, is the type of online advertising that helps keep your brand in front of potential customers after they bounce from your website. Since only 2% of traffic converts on their first visit on average, retargeting can be a powerful tool to bring customers back and increase conversion.

Basic retargeting has become common practice in digital advertising, and customers are starting to take notice by not responding to retargeting ads like they used to. In order to avoid “retargeting fatigue”, you can add life events as part of your retargeting criteria to focus your reach on prospects who are more likely to convert.

Another way to increase retargeting efficiency is to combine your targeting criteria with location-based services or mobile geo-targeting, which is particularly helpful to brick-and-mortar banks. Location-based services use real-time geographical data from a customer’s mobile device to serve up relevant ads at a relevant time.

For example, you have physical branches in certain neighborhoods and you have identified people who are switching jobs as your target customers (when they’re most likely to switch bank accounts and set up a new direct deposit). You can retarget your website visitors who have been identified as someone in the process of switching jobs with a relevant ad as they pass by one of your branch locations.

Whatever channel strategy you decide to use in order to increase conversion, your campaigns should be enhanced with life events data. Even if you start by using simple address change data to target potential customers, you will find that being in the right place at the right time (with the right message) is more important than ever to maximize customer acquisition.

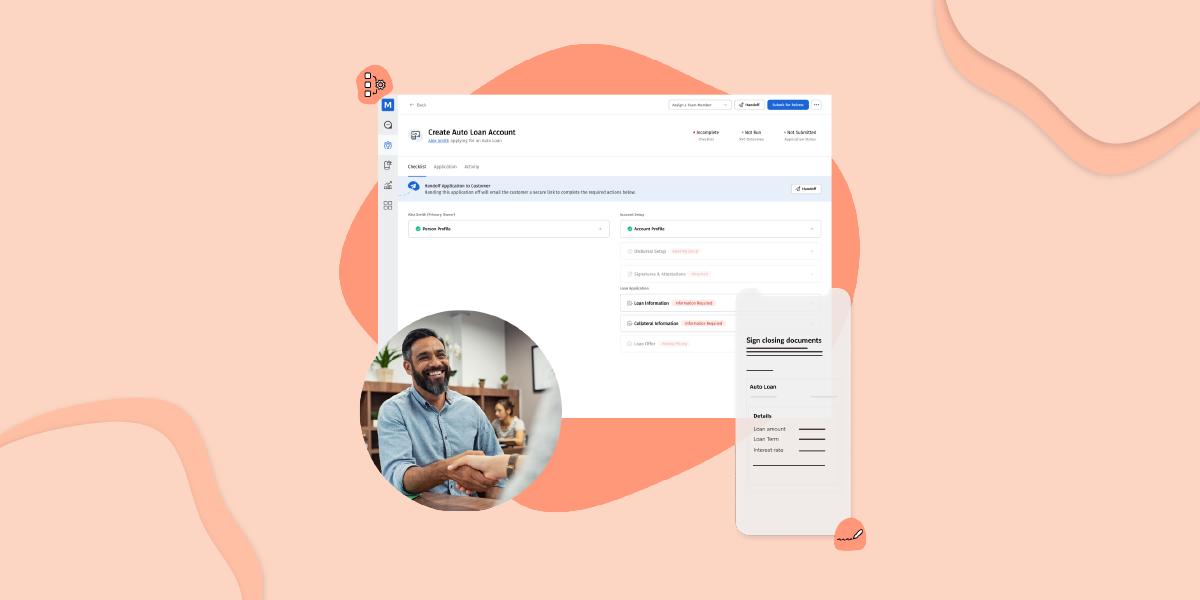

Learn more about MANTL’s optimized conversion flow.