By automating compliance procedures across digital channels, banks can ensure a safe and streamlined customer experience.

For banks, pursuing digital transformation also means modernizing compliance processes, particularly in response to regulations designed to prevent fraud, money laundering, and other criminal activities. Chief among these are Customer Identification Program (CIP) requirements (known more informally as “know your customer” or “KYC” guidelines) and Bank Secrecy Act (BSA) requirements.

Typical procedures for meeting these regulatory requirements can be time-consuming and detrimental to customer experience, which in turn can lead to higher rates of application abandonment and customer drop-off. Customers’ time is precious, and research has shown that every 10 seconds added to the application process directly correlates to a 5 percent increase in application abandonment.

Fortunately, compliance automation technology can help banks streamline customer experience while fully adhering to regulatory requirements. To deploy digital solutions most effectively, banks should keep the following strategies in mind.

1. Design separate digital and in-branch experiences

As banks build out their strategies for digital banking, it’s worth differentiating digital and in-branch customer experiences. Customer preferences and expectations vary depending on channel — and customers transacting online expect a faster experience with fewer barriers to action.

For instance, during in-branch account opening, banks may give customers printed disclosures that they store digitally as PDFs. Online, however, PDF files are opened and downloaded in a separate tab, which takes focus away from the application page. Instead, converting disclosures into HTML simplifies the digital attestation process, which can facilitate the account opening process and prevent application abandonment. Such solutions are also more considerate of vision-impaired customers, who may use assistive technology to read the file through text-to-speech.

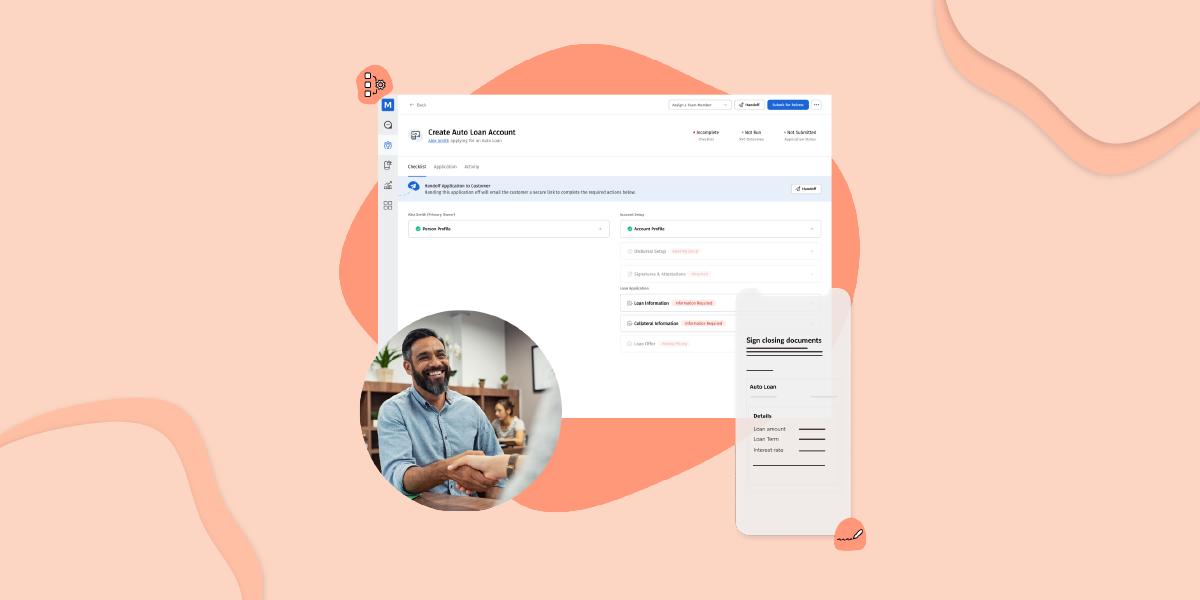

Similarly, during in-branch account opening, banks may reasonably ask to see physical copies of customer ID documents. But during a digital experience, customers might view this requirement as a barrier, and may choose to navigate away from the application rather than retrieve the requested documents. However, the Federal Financial Institutions Examination Council (FFIEC) and other regulatory bodies allow for non-documentary customer identification methods. With non-documentary procedures built-in, MANTL’s account opening platform allows banks to bring new customers on board painlessly and in full regulatory compliance.

In building a digital experience, banks have the opportunity to create customer-focused solutions that perform compliant customer ID checks, but that don’t slow down the approval process. Banks should also take advantage of digital channels to update and improve decision waterfalls where appropriate, based on feedback or changing guidelines. With the right tools and processes in place, compliance teams can continually evolve their best practices to assess risk, adapt to regulatory changes, and reduce fraud.

2. Leverage multiple data sources for identification

In order to verify customer identity in a way that meets or exceeds compliance requirements, banks should look to leverage multiple data sources across the digital account opening process. For instance: when applying for an account, a user might be asked to provide information like name, date of birth, Social Security number, address, phone number, and email. An online application through MANTL can also gather information passively — information like browser type, IP address, and linked bank account information. It’s possible to then compare this information to other data available from public and private sources in order to build a more complete picture of the applicant’s identity.

Importantly, this automatic data comparison goes on behind the scenes without interrupting or slowing down the front end user experience. And for the bank, the KYC decisioning process can be expedited and made more accurate, with a higher level of certainty that the application is not fraudulent.

3. Use real-time data for more effective risk management

Online banking is the future. But without proper deployment and oversight, digital innovation can introduce risk, including cybersecurity threats and identity fraud. As banks roll out online account opening capabilities, they must anticipate potential risks in the customer application approval process.

As part of the underwriting process, banks must be able to accurately assess risk in order to approve or deny applicants. To that end, banks need access to a range of appropriate data, including transaction data, social media, and more. With MANTL’s platform, banks can automatically leverage a robust cross-section of data to quickly inform credit decisions, with an accuracy rate that may equal or surpass the use of physical documentation.

This process can be automatic and occur in near real time — to the benefit of both banks and customers. Customers enjoy a speedier process with fewer barriers, while banks benefit from highly accurate and fast KYC decisioning that minimizes the possibility of fraud. Banks can also use this real-time outlook to easily alter underwriting parameters when necessary and thereby create a more forward-looking measure of risk. Similarly, real-time data processing, reporting, and monitoring can further improve risk management capabilities.

4. Encourage greater transparency with digital record-keeping

While digital channels may present some compliance challenges, they offer critical built-in opportunities as well. Online account opening allows record-keeping, for example, to be automated to a great extent (as well as made more granular) compared to in-person. With MANTL, the entire application process is time stamped each step of the way: when the customer begins the application; when the data is collected and verified; when the decision is made and sent to the applicant; and so on.

Banks can use such detailed information to better understand performance, view customer sticking points, and more easily make improvements to their processes. It is also invaluable for compliance purposes, as banks can provide auditors with highly detailed and organized data.

Digital compliance automation made easy

Despite the numerous advantages of digital banking, financial institutions sometimes hesitate to develop digital channels because of uncertainty around compliance. Digital banking providers are sympathetic to these concerns, and account opening software like MANTL’s offers built-in customer identification programs, with non-documentary KYC methods, multiple data sources, and other features to minimize risk.

By combining the right technology with a carefully tailored compliance strategy, banks can build successful digital processes that meet CIP and other regulatory requirements — without sacrificing an efficient and effective customer experience.