Growing deposits online means doing a lot of things well. From Marketing channel optimization tactics, to online account opening flow improvements, there isn’t a shortage of levers one can utilize to grow the customer base and subsequent deposits. One of the most overlooked competencies is learning how to increase the initial funding amount, or the amount of money a customer deposits at your financial institution when they sign up for an account.

At MANTL, when we start working with clients we always ask: what is your institution optimizing for? The answer should always be conversions – which are the number of people that sign up for accounts at your bank – but we can go deeper. Do you want to optimize for number of new account relationships? Or cost of a new dollar of deposits?

Your answer will affect strategy. If you’re looking to optimize the dollar cost of deposits, we usually recommend a Savings and CD product mix, and if you’re maximizing for number of new relationships – you should focus on Checking accounts. Within both of those basic choices, there are a number of levers that are largely behavioral, that we can use to achieve different outcomes.

Behavioral changes to your online account application decrease cost of deposits

MANTL’s data shows that increases in the minimum funding required for opening an account will decrease conversions, but increase average account funding. This inverse relationship is obvious. But why does it matter?

Our data also shows that the decrease in conversions is more than offset by the increase in average funding amount – meaning you get a lower overall cost of deposits. With that kind of outcome, it’s clearly worth testing different minimum funding requirements with your customer base to identify the perfect balance between new accounts and new deposit amounts that works for your organization.

Technology can multiply initial funding of online accounts

Similarly, our data shows that when a person doesn’t know how much money is in their existing bank account, they are more likely to fund either the minimum required by your bank or a “safe amount” for fear of overdrafting.

Here’s a simple test: Ask yourself how much is in your checking account right now? You may directionally know, but not the exact amount down to 100s or even 1,000s of dollars in some cases. So if I asked you to send me money right now, how much would you be comfortable sending without fear of overdrafting? The answer is likely the minimum amount possible.

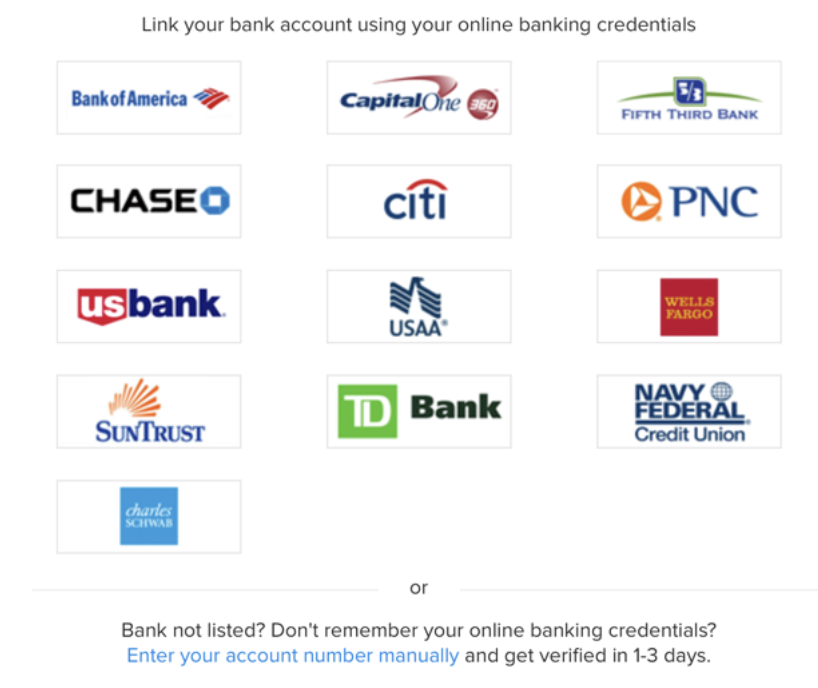

There are enormous benefits to using IAV (Instant Account Verification) during the onboarding process, but this is another place where IAV really shines.

With respect to initial bank account funding, MANTL’s IAV integration presents real-time balances from external accounts during the funding process, which allows individuals to make funding decisions with perfect information about their existing balances, therefore increasing their funding amounts. In fact, initial funding amounts from online account opening flows using IAV are on average three times higher.

Combining the technology available today with tweaks to the configurations of product setup based on behavioral science, banks and credit unions can improve the customer experience and ultimately drive increases in initial funding amounts.

Learn more about how you can decrease the cost of deposits with MANTL’s online account opening.