Here’s how community institutions can enjoy the benefits of digital transformation while maintaining a personalized, high-touch approach.

Key points:

- Digital channels are a critical way to attract and retain customers and ensure long-term success for your FI.

- You can adapt your people-first strategy to enable the success of digital channels.

- Obstacles to embracing digital transformation can be resolved with the right technology and vendor support.

It’s clear by now: community banks and credit unions that commit wholeheartedly to digital transformation will see better results. Buy-in from both leadership and branch staff is necessary to kick off any digital project, and your FI’s employees should feel confident weaving technology into both strategy and day-to-day operations.

Yet some financial institutions hesitate to embrace digital transformation. Employees voice concerns ranging from the logistical (“what will this mean for my performance review?”) to the fundamental (“will this change what kind of bank we are?”). And as digital tools become more essential in today’s competitive landscape, these questions will only become more difficult to ignore.

Despite concerns about the growth of digital banking, it’s clear that high-touch banking isn’t going anywhere soon. Nor should it. In fact, digital tools can make it easier for bank or credit union employees to deliver great personal service, all while helping FIs compete more effectively.

Here’s how employees can leverage digital tools without losing what makes their FI special.

Why digital transformation matters

To stay competitive and secure your FI’s future, it’s important to view digital tools like online account opening (OAO) as a long-term investment, akin to building a new brick-and-mortar branch. Consumers of all ages are increasingly using digital banking, with the American Bankers Association (ABA) reporting that 71% of Americans look primarily to online and mobile channels for their banking needs.

By investing in a top-quality account opening platform, your FI can boost new account creation by 20 percent. For many community institutions, this is even better than their best-performing branch.

Further, OAO can actually make your brick-and-mortar branches more successful. Digital services expand the geographic range and “gravity” field of each branch, enabling you to reach more customers with fewer resources. According to the Financial Brand, consumers in urban areas who are offered the best digital banking services would be willing to travel nearly 37 minutes by foot to visit a branch. For suburban and rural areas, consumers would be willing to drive 27 minutes to a branch, provided they’re also offered the best digital banking services.

In addition to enhanced customer acquisition, OAO solutions make it easier for branch employees to reach their goals. High-performing platforms offer over 90 percent automated decisioning, real-time core integration, and automated customer engagement capabilities. These features reduce the need for time-consuming manual review and manual data entry. Less manual work means that branch staff have more time to focus on what matters most: building relationships with customers and addressing any challenges that occur.

In fact, as more and more rote processes move online, consumers are actually seeking out human connection and personalized expertise when their needs can’t be met with the click of a button. This means that empathy remains a key skill for in-branch staff—and employees who aren’t bogged down with manual tasks can dedicate more time to high-impact personal service.

How to address cultural challenges

Despite the benefits of digital transformation, some FI executives and branch employees may be wary about embracing new technology. The high-touch approach to banking has historically been very successful for community banks and credit unions, allowing them to carve out an important place in their chosen markets—and digital channels are often seen as a disruption of this model. As community FIs pride themselves on person-to-person connection and exemplary service, they may view online banking as too impersonal or inflexible to become a key part of their culture.

However, OAO solutions can actually serve as an important step in a high-touch model by ensuring that the onboarding process is quick, efficient, and even enjoyable. As the first point of contact for new relationships, OAO helps your FI gain credibility and trust, setting the stage for a positive customer or member experience. Moreover, high-performing OAO solutions allow greater visibility into customer or member applications, allowing a greater degree of insight and personalization.

Navigating attribution concerns

It’s true that attribution of new digital accounts can be a challenge, as these accounts are extraneous to your FI’s brick-and-mortar branch network. However, there are several simple and fair ways to attribute digital accounts and offer branch employees the credit they deserve. For instance:

- You can attribute digital accounts to your FI’s headquarters

- Digital accounts can be attributed to the nearest branch

- Digital applicants can receive a promo code that links them to a particular branch or staff member

- Your FI could establish a separate digital branch to attribute digitally originated accounts

Though there may be some hurdles to overcome, digital channels should ultimately make things easier for both consumers and branch employees. When staff members are freed from time-consuming manual tasks, they can focus on high-impact work like fostering relationships with new and existing customers.

Fitting OAO into your mission

Community banks and credit unions succeed by making customers happy, and the right tools make it easier to execute on that mission. Contrary to some common misconceptions, digital channels actually empower your FI to continue with a high-touch approach to banking that prioritizes personalized service, clear communication, and understanding local needs.

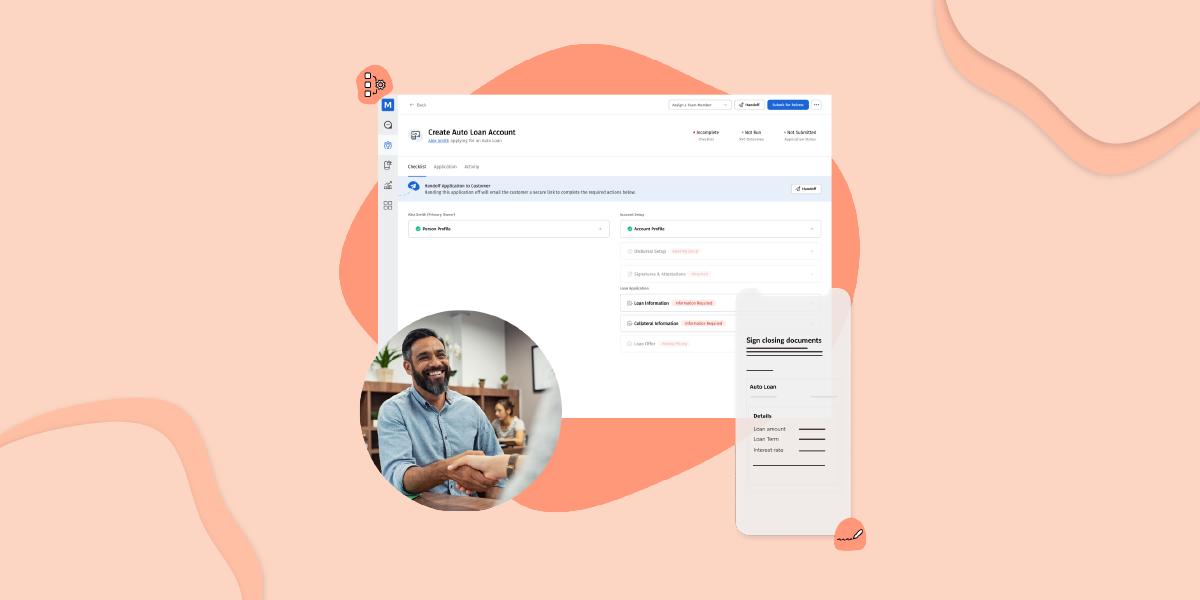

With MANTL, opening an account online is simple, straightforward, and convenient. It’s the best of both worlds: an OAO solution that drives real, measurable outcomes for your FI, but isn’t burdensome for staff to understand and implement. MANTL empowers your FI to deliver the experience your customers or members want—no matter the channel.