View the original article on American Banker.

That Radius Bank in Boston would strike another fintech partnership — it announced one Wednesday with the startup Mantl, which is trying to cut down online-account openings to four minutes — is less revealing than its part in Radius’ evolving MO.

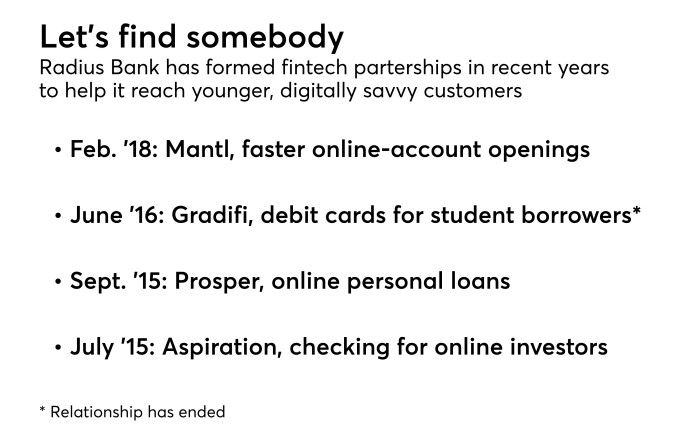

The $1 billion-asset bank is aggressively pursuing fintech partnerships. Radius collaborated with the online investing company Aspiration in July 2015 to create a checking account for Aspiration customers. Two months later, it worked with the online lending company Prosper Marketplace to offer a new personal loan option through the Prosper platform. It paired with Gradifi in June 2016 to offer a debit card for which rewards can be used to help pay down student loans, though that relationship has ended since Gradifi’s sale to First Republic Bank.

These aren’t acqui-hires nor raids of fintechs’ intellectual capital. Radius and its partners seem to be trying to establish long-term relationships that are mutually beneficial.

“It’s all apparently designed with the aim of serving up-and-coming millennials who might up-and-come faster if they could shed the weight of student loans,” said Mark Schwanhausser, director of digital banking at Javelin Strategy & Research. “I’d give Radius Bank credit for asking itself some critical questions: Who are we trying to serve, how can we stand out from the crowd, and can we achieve that better by partnering?”

Radius Bank’s fintech partnerships

Mike Butler, the bank’s CEO, says much the same but sees the bank appealing to all digitally minded consumers.

“We’ve built a culture inside this company that believes in the future of virtual banking, and the demands clients are going to put on us to be an Amazon-like experience for them,” he said. “We believe that over time, the difference between an Amazon client and a bank client will be minimal and the expectations will be high.”

It’s hard for banks to reach Amazon-like levels of usability on their own, he said.

“We recognize that we need to work with strategic partners to get to that place faster, because the ecosystem in which we operate as a traditional bank doesn’t necessarily have all the answers for us,” Butler said.

Teaming up to speed things up

Radius’ pursuit of the Holy Grail of fast account opening is a perfect example of its philosophy.

When Nathaniel Harley, CEO of Mantl, first visited Radius, he was seeking feedback on a personal financial management technology the company was working on. But he was quickly talked into changing the direction of his company.

“Chris and I challenged them that PFM wasn’t the biggest issue in the industry, but the biggest issue was frictionless account opening,” Butler said.

Mike Butler, CEO of Radius Bank

Digital gold standard

“We believe that over time, the difference between an Amazon client and a bank client will be minimal and the expectations will be high,” says Mike Butler, CEO of Radius Bank.

The bank had decided that the customer experience of opening accounts “was just bad,” Butler said. “We’ve gotten to the point where, if I have to make a customer wait seven seconds, they give up on the app.”

The two companies started building an account-opening system for all digital channels in March 2017. They worked to reduce manual entry and other hassles from the account-opening process. Mantl brought in one of its own fintech partners, Alloy, to handle much of the decisions, including anti-money-laundering checks, identity verification and fraud detection. Radius and Mantl used Alloy’s workflow management tool to configure the decision-making process.

They cut in half, to 23, the number of fields an applicant has to fill in. In one example, the software automatically scans outside sources to determine if an applicant is a politically exposed person, rather than having the person answer that question.

“We’re using so many data sources on the back end in partnership with Alloy to be able to come to an automatic decision 98% of the time, so you don’t have this really long wait time,” Harley said. “When you sign up for an account, you get a decision in real time.”

Other partners in the effort include Plaid, First Data, Twilio and SendGrid.

Mantl has also built what it calls an infrastructure layer that lets its own software and its partners’ technology integrate with a legacy core system — in Radius’s case, an FIS system.

“This allows them to tap into modern, best-in-class fintech companies,” Harley said.

In a side benefit, the new technology lets the bank gather far more data about customers than it did in the past.

“At the end of any given day, I can tell you how many clients we approved for a deposit account that used an iPhone versus an Android or a tablet, and which digital marketing channel they used, recast that data and redeploy it” for digital marketing campaigns, Butler said.

Some banks would balk at a four-minute digital account opening process in this age of rampant identity theft and account takeover fraud. Butler acknowledges the danger.

“In the virtual banking world, you’re going to attract a higher level of people who will try and commit fraud versus those that walk into a branch, there’s no question in my mind,” he said. Yet he said he is confident in the new process.

The new technology performs identity checks, looks at past banking behavior, collects hundreds of data points from the prospect’s social media profile and contact information, and cross-checks all of that against their IP address, says Chris Tremont, an executive vice president at Radius.

“No system will be 100% perfect,” Tremont said. “By the time we’re able to get through an application and the automated decision process, we really feel we know who we let into the front door.”

The bank uses a “risk waterfall” through which people who pass all software checks easily slide through, Butler said. Applications that raise red flags prompt additional questions until the system is satisfied.

The bank reports several benefits from the new software: The time it takes to complete an application has dropped 60%. Because 98% of decisions are automated, the number of employees needed to manually review applications has been cut 95%.

At the same time, account-opening fraud has dropped 50%, conversion of applicants to account holders has increased 250%, and initial funding in accounts has grown 300% (because more funding options are available).

Building strong fintech relationships

Choosing a fintech partner is not that different from deciding which bank to merge with, Butler said. The first consideration is culture.

“You never want to say this fintech company has a good product but we’ve disconnected culturally … but I’ll make it work,” he said.

A project management team constantly considers the risks of new products and vendors, he said.

“Every step of the way we’re going to document ‘what-ifs,” Butler said. “What if Mantl doesn’t deliver this technology or what if their technology fails? And we have backups and solutions.”

The compliance department helps by taking a positive view of new technologies and companies with an eye toward “how can we get it done,” Butler said.

The bank also works on its relationships with regulators, who have been cracking down on vendor relationships in recent years, imposing tough requirements around how vendors are vetted, monitored and managed.

“We’ve been very proactive,” Butler said. “We spend a lot of time with our lead regulator, making sure he understands our vision and what we’re trying to accomplish, and we in many cases ask him to do a pre-review of what we’re going to do and our project plan; we get their two cents early on.”

Butler credits Tremont, the youngest person on the bank’s executive committee, with being instrumental in forging partnerships.

“He’s our ‘cool dude’ we bring in who understands the business” yet can still look at things from a conservative viewpoint, Butler said.