Business Account Origination That’s Scalable

Originate Business Accounts Anywhere, Anytime

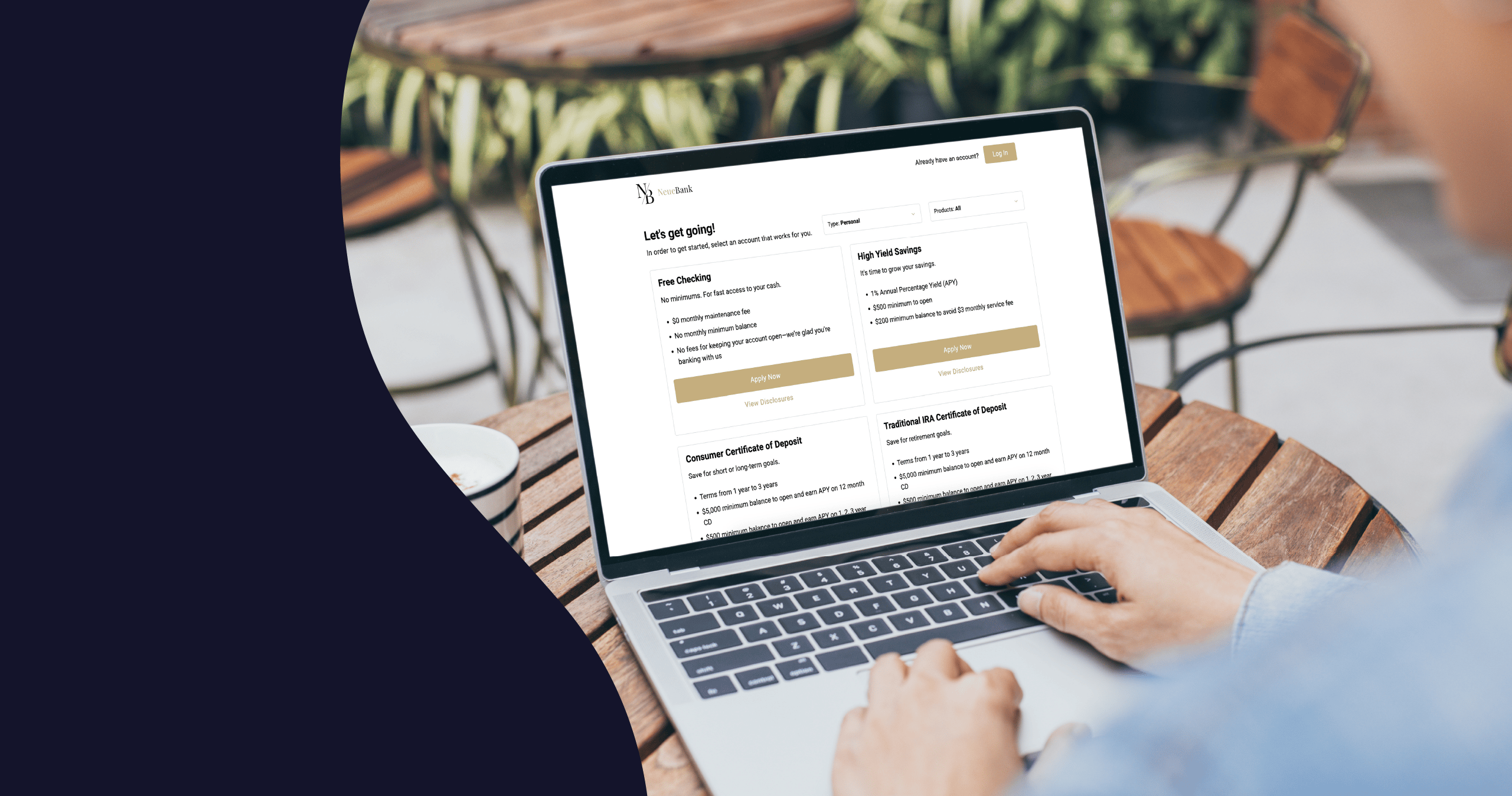

With omnichannel deposit origination, you can meet your highest-value customers where they want to be met.

- In-Branch: Allow businesses of all complexities to walk into your branch and have bankers successfully open and fund an account in one sitting

- In the Field: Equip relationship managers with the tools to originate and upsell accounts during onsite visits

- Call Centers: Empower your call centers to re-engage and complete abandoned applications directly on the phone without requiring an in-branch visit

- Digital: Allow simple businesses to originate an account online without staff intervention

Partnering with MANTL ensures that Grasshopper Bank will deliver a fast, frictionless onboarding experience while helping the bank lower deposit acquisition costs as we expand and deepen our impact in the SMB market.

Mike Butler

President and CEO

Grasshopper Bank

Transform Service Channels into Sales Channels

Empower your bankers to focus more on prospecting and cross-selling and less on paperwork.

With an intuitive platform, increased automation and a remarkable customer experience, MANTL customers are:

- Achieving record sales quota attainment after implementing Business Deposit Origination across branches

- Able to train staff and utilize the product across their branch networks in 30-60 days

- Seeing an increase in customer referrals and satisfaction

- Growing accounts out of footprint while maintaining a highly personal approach

Adaptive due diligence tailored to each business

With configurable decisioning and adaptive due diligence, MANTL Business Deposit Origination improves employee efficiency and maximizes conversion, while minimizing fraud.

The MANTL platform offers:

- Tailored application requirements based on the business and account type – MANTL automatically flags the need for EDD and notes which documents to collect.

- Configurable KYC waterfalls based on your unique risk strategy.

- Streamlined manual review process including KYC/KYB tags that explain why business have been flagged.